DRAFT Budgeting and Financial Management Policy - URS

The Uniformed Retirement System, as a component unit of the County, must adhere to the budgetary and financial management policies of the County. The County operates on a fiscal year basis, beginning on July 1st of one year and ending on June 30th of the next. Budget development begins in the fall prior to each fiscal year and ends with adoption by the Board of Supervisors in April before each fiscal year.

Staff will answer any questions raised by the Boards and will provide additional information as requested. The retirement Boards will then be asked to approve the budget for their respective system for submission to the County's Department of Management and Budget.

Staff will answer any questions raised by the Boards and will provide additional information as requested. The retirement Boards will then be asked to approve the budget for their respective system for submission to the County's Department of Management and Budget.

On an ad-hoc basis, the County's internal auditors will perform audits of the systems' finances, operating practices, technology integrity and security, and other areas as they see fit.

Sources of Funds

The retirement systems each have accounts with the custodial bank and within the County's financial system.Custodial Bank Accounts

The three retirement systems each have a custody account with BNY Mellon; which are used for custody of the systems' investable assets. The only financial transactions that are made in BNY Mellon's systems are for:- Funding new investment managers

- Increasing allocations to existing managers

- Liquidating investments from terminated managers

- Funding monthly benefit payments

County Financial Accounts

All other financial transactions are processed in the County's financial system (FOCUS). These include paying for:- County, schools, and employee contributions

- Staff salaries and benefits

- Retiree and beneficiary benefits

- Actuarial valuations and studies

- Building rent

- Supplies

- Technology-related expenses

- Professional services

Approval of the Budget

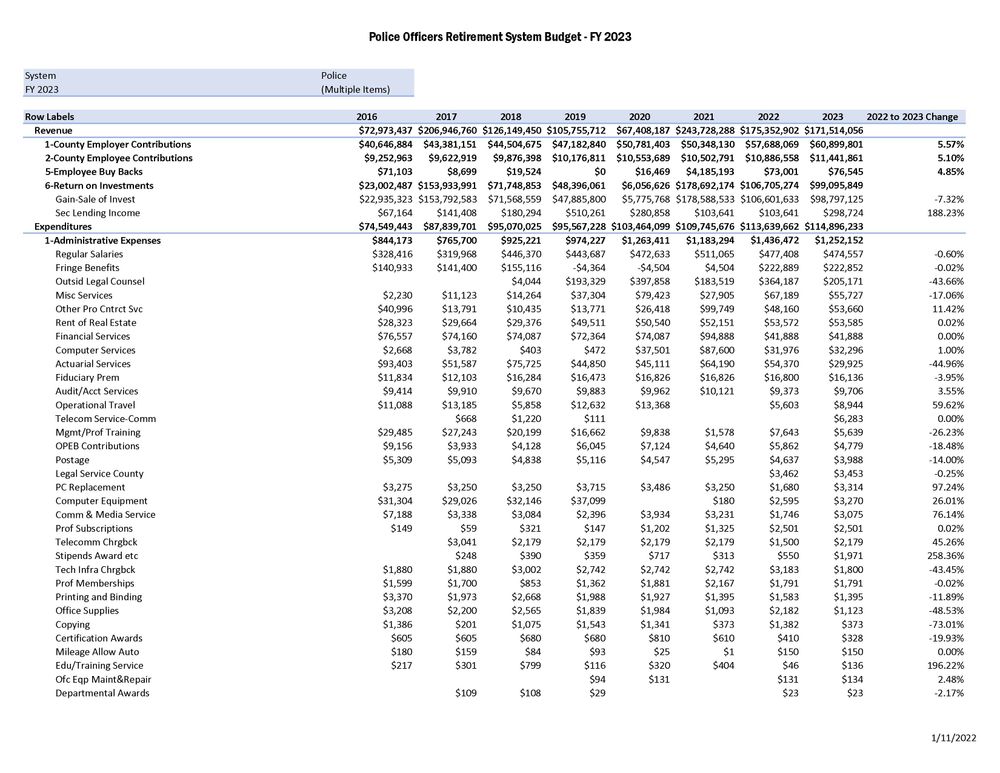

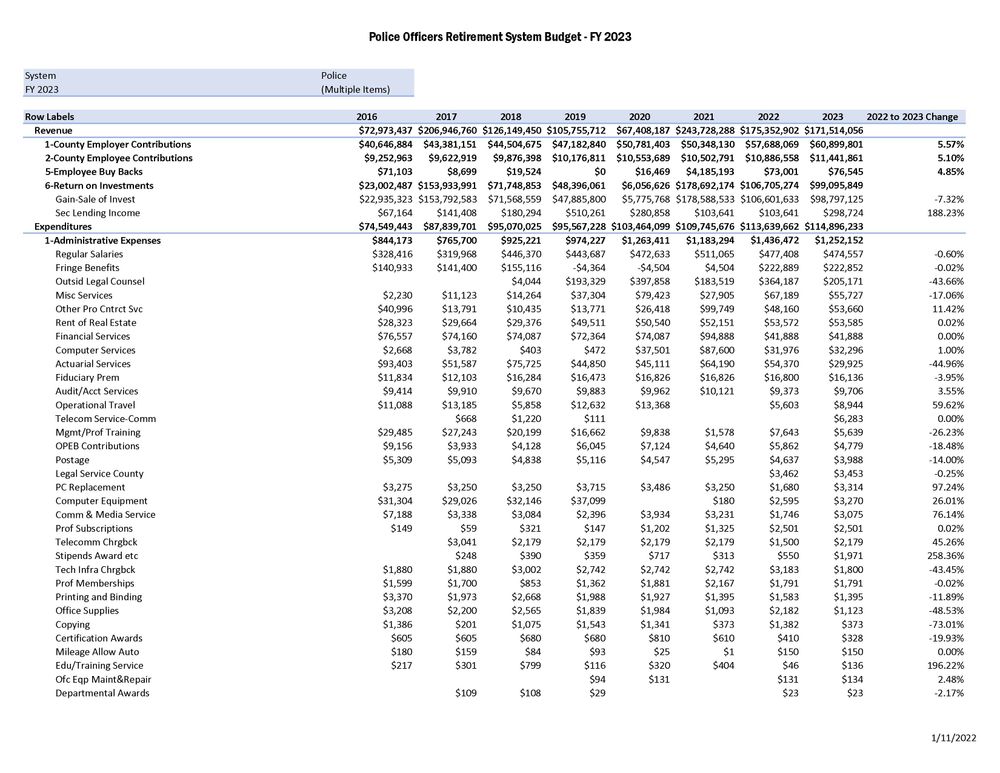

At their December or January meetings, staff will present to the retirement Boards the proposed budget for the next fiscal year. This will include historical revenues and expenditures for each general ledger account in the County's financial system. Increases or decreases of more than 5 percent will be highlighted along with explanations. Staff will answer any questions raised by the Boards and will provide additional information as requested. The retirement Boards will then be asked to approve the budget for their respective system for submission to the County's Department of Management and Budget.

Staff will answer any questions raised by the Boards and will provide additional information as requested. The retirement Boards will then be asked to approve the budget for their respective system for submission to the County's Department of Management and Budget.Disbursement of Funds

The Board is authorized, per County Section 3-3-16(b) to pay for services, specifically they:may employ and pay out of the System funds for all services as shall be required.The Board Treasurer is further directed, per County Code Section 3-3-18 to:

deposit all money in the name of the Board and disburse the same only on vouchers signed by such person as is designated for the purpose by the Board.

Audits

The Board, per County Code Section 3-3-16(e)::shall submit to the Board of Supervisors annually an independent audit showing the fiscal transactions of the System for the preceding fiscal year, the amount of accumulated cash and securities of the System, and the last balance sheet indicating the financial condition of the System.Every year, after the end of the fiscal year (June 30th), the County-hired audit firm will review each retirement system's financial records. During this process, these external auditors will recommend changes to accounting practices as warranted. Ultimately, at the end of their audit, the external audit will issue either an unqualified opinion regarding the systems' finances or will issue an opinion with qualifications (deficiencies) that need correcting.

On an ad-hoc basis, the County's internal auditors will perform audits of the systems' finances, operating practices, technology integrity and security, and other areas as they see fit.

Annual Comprehensive Financial Report

Each year, after the end of the fiscal year, staff will produce an annual financial report called the Annual Comprehensive Financial Report (ACFR). These reports, which are made available on the systems' website, include information and data regarding:- Organizational structure

- Financial results and footnotes

- Investments

- Actuarial data

- Statistical data