Last Updated on March 3, 2025 by Owen McGab Enaohwo

Every business has to abide by corporate rules to ensure they don’t waste money and productive time in fighting legal battles, paying fines, experiencing low productivity, or losing their customers.

Studies have shown that 73% of leaders state that meeting compliance standards improves the perception of their business.

In this post, we’ll show you what compliance management is and the different approaches to easily create, implement, and manage it in your business.

For up to 14 days, you can try SweetProcess for free and see how it can help you implement compliance in your business without stress.

What You’ll Learn In This Guide:

What Is Compliance Management?

Why Is Compliance Management Important for an Organization?

How to Implement Compliance Management in Your Company

How to Create a Compliance Management Program on SweetProcess

Benefits of Compliance Management System

Approaches to Compliance Management

Level up Your Company’s Compliance Management With SweetProcess

What Is Compliance Management?

Compliance management refers to the continuous process of analyzing and assessing business systems to ensure they align with relevant laws, industry and security standards, corporate policies, and regulatory requirements.

It also involves compliance risk management and the adoption of standard policies and procedures to ensure adherence to these compliance requirements.

For up to 14 days, you can use SweetProcess to manage your company’s compliance processes for free, without stress.

Why Is Compliance Management Important for an Organization?

Here are some of the reasons it’s important to be compliant as an organization:

Maintains Reputation and Trust

Being compliant gives the green light that you are transparent and have integrity. This helps to enhance your brand reputation, build trust with stakeholders, attract investors and top talent, giving you an edge over your competitors.

And by maintaining this good outlook, you can establish your business as a reliable brand in your niche.

Shields From Data Breaches

Setting up compliance measures protects your company’s sensitive data and reduces cybersecurity risks. This includes protecting customer privacy and reducing data leakage and cyber attacks from hackers.

When you prioritize the general data protection regulation, you can reduce the risk of data breaches and financial theft and retain customer trust. Good compliance measures help you to respond quickly and efficiently if your data gets breached at any point.

Protection From Legal Penalties

By default, once your organization prioritizes regulatory compliance, it helps you to avoid potential compliance risks, fines, and sanctions. By being compliant, you can minimize the risk of non-compliance, avoid having a bad reputation, reduce your expenses, and help keep your business stable amid economic crises. This way, your operational costs stay low, and your profit grows.

Ethical Conduct and Business Practices

It helps to foster a culture of ethical practices and integrity among your employees in your workplace.

That’s because compliance helps encourage your employees to align their daily operations to industry standards. This leads to better products and service quality, making your customers return to patronize your business.

Strategic Decision-Making

Compliance management also gives you valuable insights to make an informed decision. This helps you minimize business risks and maximize brand-building opportunities.

Also, it helps you stay updated about legally approved practices and ever-changing regulations that guide business compliance so you can stay ahead of the competition.

To easily manage compliance in your business, you can try SweetProcess for 14 days free. No credit card is required.

How to Implement Compliance Management in Your Company

To avoid legal tussles and adhere to relevant authorities, follow the steps below to protect your business:

Identify Relevant Laws and Regulations

Getting it right with compliance is, first, identifying relevant laws and regulations that apply to your industry, whether it’s federal, state, or local laws. And in case it’s a global business, you are safe if you keep tabs on the ever-changing international laws and politics. For instance, you can implement this by consulting a lawyer to ensure you meet all their expectations.

Perform Risk Analysis

Nothing beats being proactive in compliance management. Hence, you need to conduct a careful risk assessment by assessing your business operations to uncover any likely compliance risks so you can patch up any loopholes and reduce mistakes. Assuming you manage important customer information like passwords, credit cards, and logins, you need to estimate the cost of data leakages and set measures to prevent them from occurring with security measures like encryption technology.

Create Compliance Rules and Regulations

Carefully lay down clear and straightforward standard operating procedures (SOPs) that match with regulatory requirements to ensure everyone is on the same page and is familiar with your expectations and their roles. For instance, as a manufacturing firm, you can have a compliance rule like “all staff must follow proper procedures for disposing of harmful materials.” Once you lay down regulations as such, it’s easier to avoid any compliance issues.

Train Employees on Compliance

Always carry out regular compliance training and awareness policies and procedures to be sure each staff knows their duty in maintaining compliance and encouraging a culture of compliance and ethical behavior. You can even use the knowledge base builder in SweetProcess to create a knowledge base for your staff training on “quality control” to check products for any defect.

Regularly Review and Update Policies

Leaving your business running without regular updates can cause legal and compliance issues down the line. You need to plan for regular reviews to update your compliance policies and procedures to stay relevant so you can mitigate any compliance violations in business operations. You can also use this period to gather real-life feedback from your staff to hear about any non-compliant issues you need to improve.

Evaluate Your Business Environment

Have the mentality of continuous improvement—that is, always analyze your business setting to see if there are areas that need adjustments. Also, sign up for a compliance tool like SweetProcess to simplify the whole process. In addition, if you launch operations in a new state, you may need to find the compliance implications of this expansion so you can start adapting on time.

Use Compliance Management Software

Like the previous point, you’ll achieve your goals faster when you have software that auto-runs awareness for your staff. This way, you don’t have to teach over and over again.

You can check the SweetProcess learning progress bar to see those who have gone through your compliance guides. This way, tracking the implementation of compliance in your company becomes easy.

The good part is you can use SweetProcess for up to 14 days free.

That’s long enough to decide if it’s suitable to implement compliance in your business without having to commit anything.

How to Create a Compliance Management Program on SweetProcess

In this segment, we’ll show you how you can use our compliance management software to create and maintain your compliance program.

Write Your Company’s Policies Manually

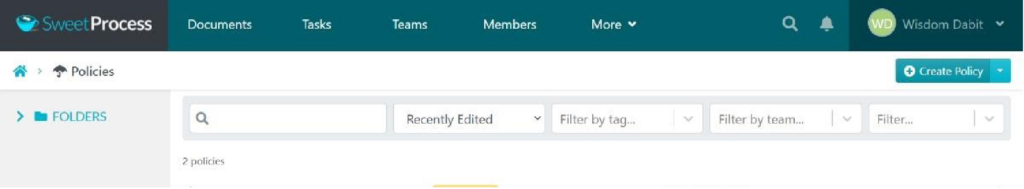

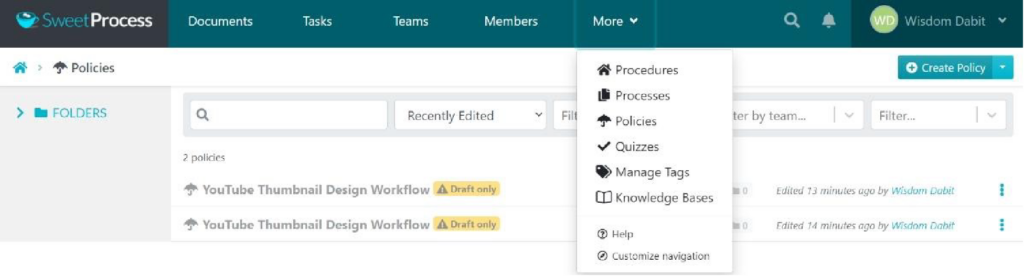

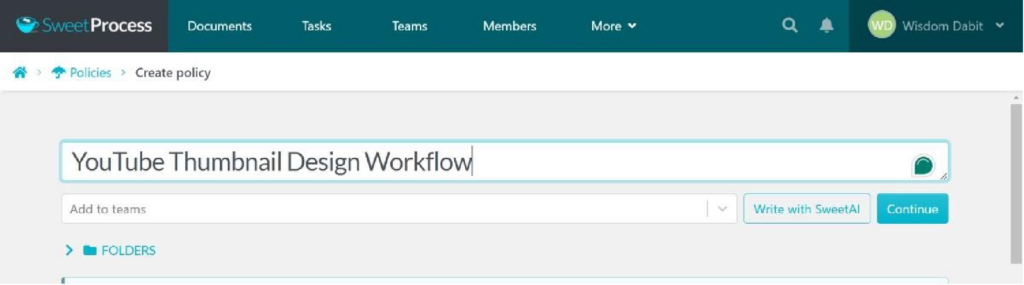

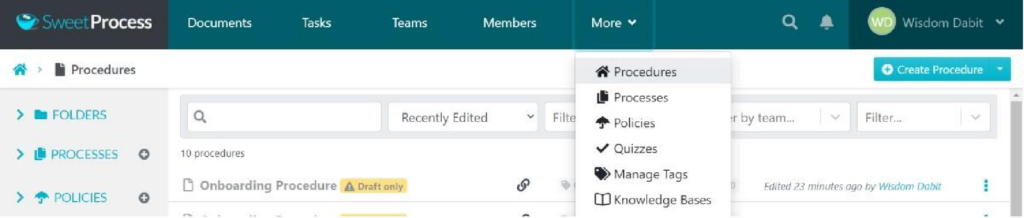

Scroll to the “More” menu, click “Policies,” then click on “Create Policy.”

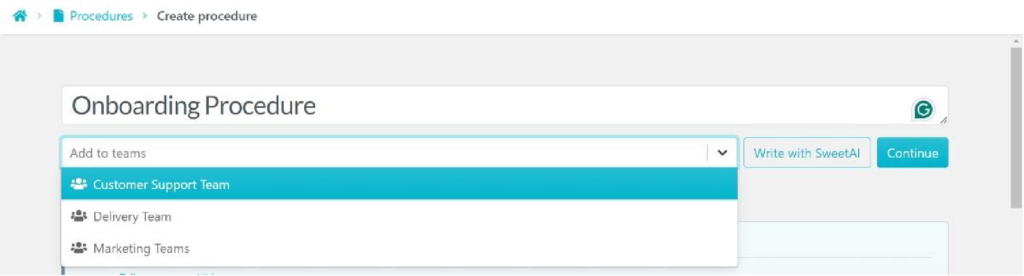

Give it a title, select a team you’ll add it to, and click on “Continue.”

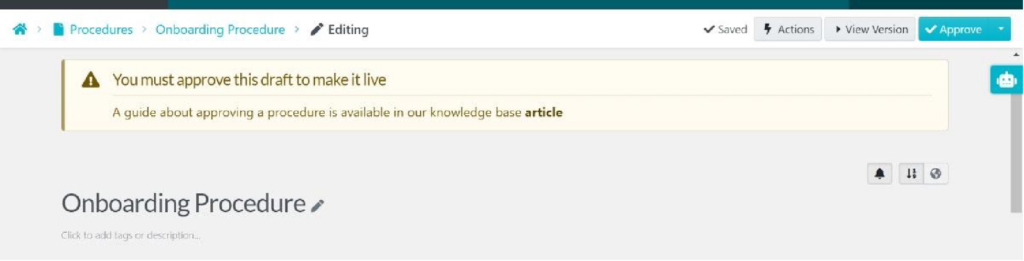

Type out the policy scope, responsibilities, or consequences by going to the “Click to add tags or description.”

If it’s up to your regulatory standards, review and approve for easy access.

Document Your Company’s Policies Using AI

Just like it’s done manually, you simply go to the “More” tab, click on “Policies,” then click on “Create Policy.”

Give it a title and click “Continue.”

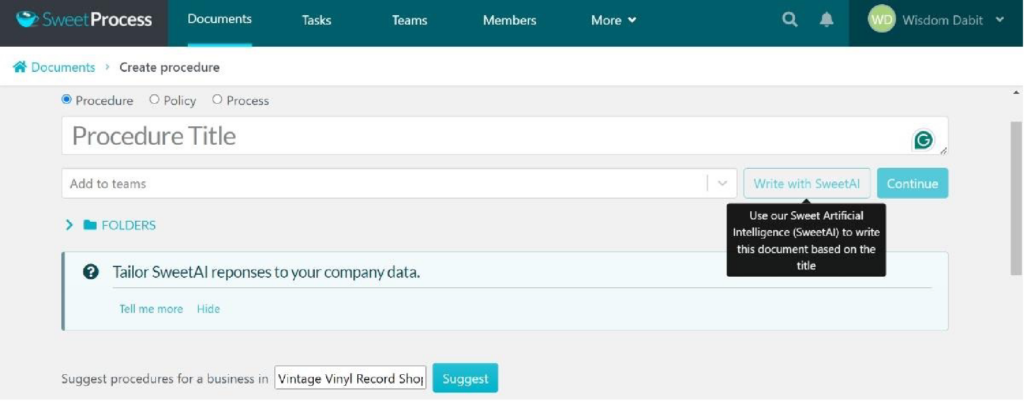

However, since you are using AI to write the policy, tap “Write with SweetAI.”

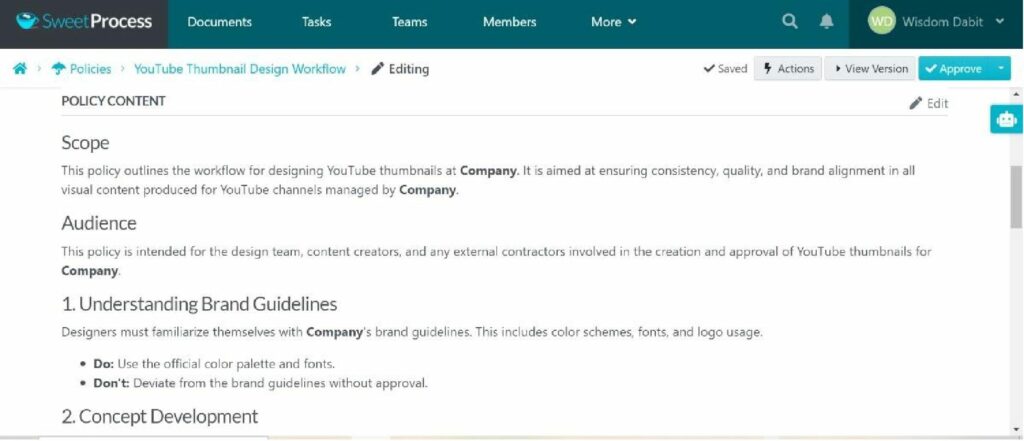

SweetAI will flesh out a decent policy manual for you in seconds, like the one below.

However, the response you’ll get will be based on the specific procedure title you type. Also, you can adjust it as you like and approve it if it’s up to your regulatory standards and ready to be shared with your compliance team members.

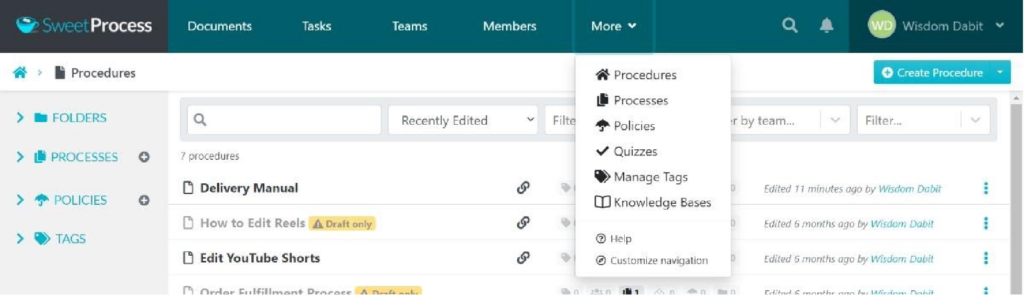

Manage Your Company’s Policies in One Place

Managing compliance policies with SweetProcess is super straightforward.

Just log in to your dashboard, and you’ll see the button bar for every important segment of the compliance management software.

Simply go to Documents, Policies, Tasks, Procedures, Teams, Knowledge Bases, etc, for anything you want to customize, create, edit, locate, or add, and you’ll be redirected in minutes.

Create an Internal and External Knowledge Base

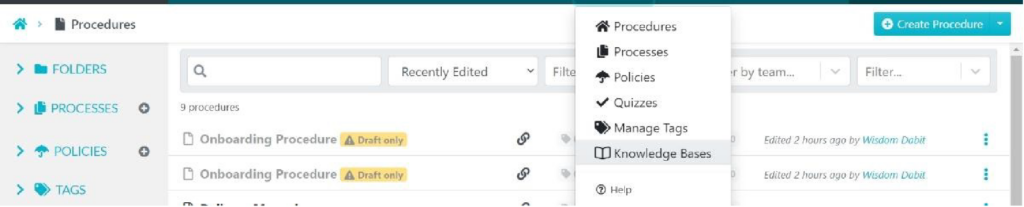

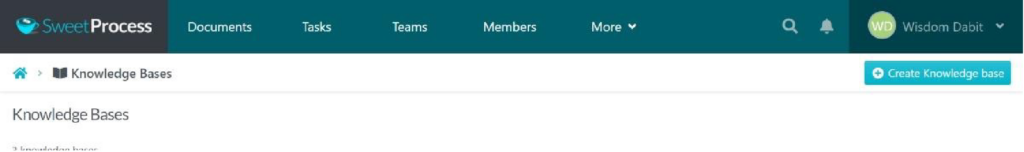

Go to the “More” button and click on “Knowledge Bases.”

Click on “Create Knowledge Base.”

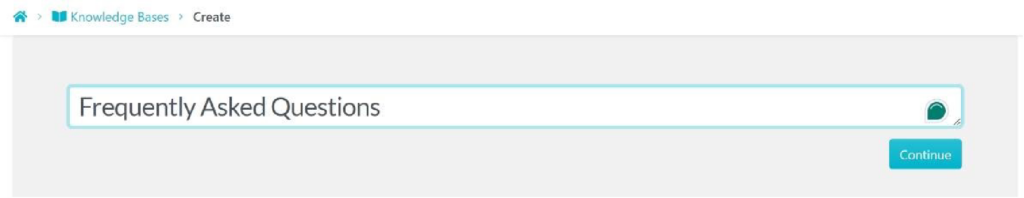

Give it a title, then click “Continue.”

Click on the writing icon beside the knowledge base title, and a type box will appear. Write your knowledge base article and select a theme if you want.

If you’re done writing your knowledge base article, click on “Approve” to save it.

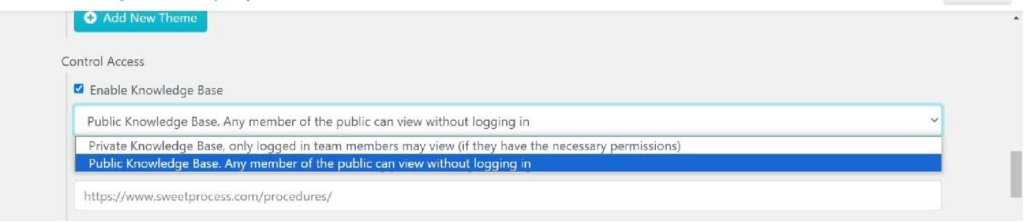

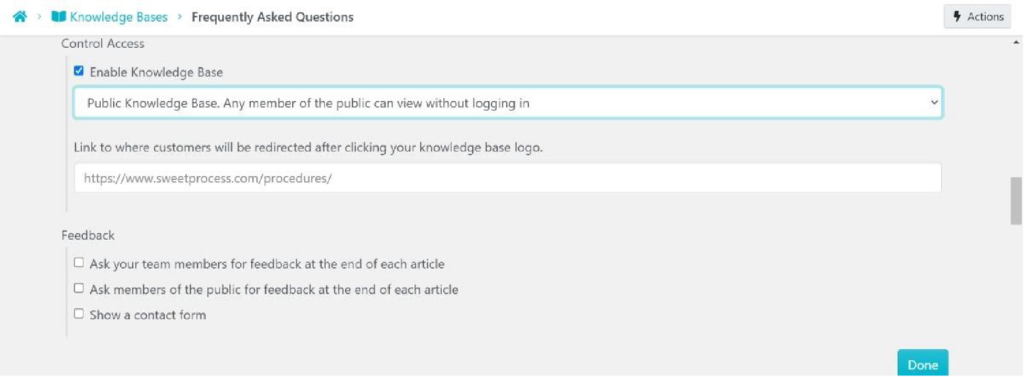

Next, scroll down and select if only logged-in teammates can view it or if it’s an internal knowledge base.

However, if it’s an external knowledge base meant for the public, tap the tick box under “Control Access” and select “Enable Knowledge Base” to allow any members of the public to view it without logging in.

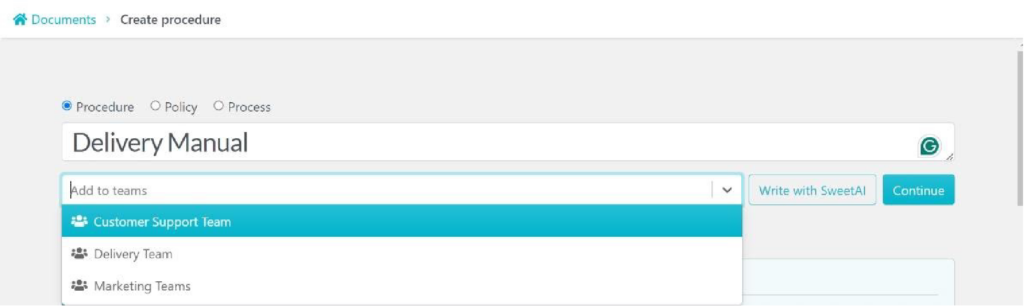

Document and Manage Your Company’s Procedures and Processes

To document a procedure or a process, go to the procedures tab and click on “Create Procedure.”

Give it a title and add it to a team.

Click on “Continue.” Add a description to make it clear for your employees to follow, then save and share.

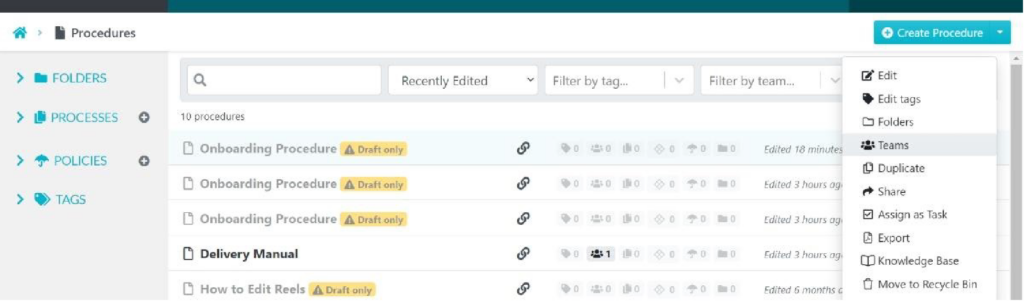

To manage it, go to the “Procedures” tab, select the one you want to modify, and click on the three dots by the side. This way, you can easily duplicate, edit tags, export, edit, share, assign as a task, or export with a few clicks.

Collaborate With Team Members and External Stakeholders

When you want to share ideas with team members, you simply make it easy by adding a feedback form to a knowledge base document you create.

You can do this if you change the access control to enable members of the public to view it.

After this, you can share it with all employees or external stakeholders, such as customers or suppliers, to enhance compliance and consistency across the company.

Many companies have used SweetProcess to manage compliance in their business, and as a result, they now have better operations and SOPs.

Take Sarah Brenner, for example, who was hired to improve Belvidere Community School District operations.

At first, she wanted to make it easy for parents and staff to access important information. Still, the problem was that their critical procedures were stored in individual employees’ Google Docs without using them. The documents were disorganized and also hard to find.

“We really thought that we had a lot of standard operating procedures across the district, but no one knew they existed because they were housed on people’s individual Google drives, Google Docs, and even Word documents. Some were handwritten,” Sarah laments.

Sarah searched for a better system and found SweetProcess, which greatly impacted how the organization worked.

She has this to say about SweetProcess:

“We started to have a generic research process via the web, and then I spent some time meeting with 10 to 15 different companies and vendors and had some web calls…. After that time, I came back to my superintendent with some pros and cons of the different organizations I connected with and then decided that SweetProcess made the most sense to work with based on some of the functionality and the everyday work that we do.”

Other companies have also benefited from SweetProcess. John Liston, the boss of Liston Newton Advisory, had a similar problem. He wanted his team to follow the procedures when doing their jobs. As the company grew, it needed new staff to come onboard.

However, it was hard to get them up to speed because important documents were scattered all over the office, and it was hard to keep track of which documents were updated.

John tried many things to fix this problem. He even tried keeping a list of old versions of document,s appointing a team leader to organize documents better.

But none of these solutions worked. The company wasted thousands of dollars trying to fix this problem. Yet every day, John’s team members would waste time searching for documents or asking colleagues how to do something.

He didn’t want the company to get stuck in a situation where people in different units were doing things differently.

In his words, “That’s the quickest way to fall over, and it’s the biggest inhibitor of growth.”

He initially found SweetProcess through a Google search and by reading a few blog posts. He also saw that it was mentioned in a “5 Ways to Write a Process” post.

At first, he was skeptical about learning the new application because he thought it would take time and that getting used to a new tool would mean changing how they manage procedures.

He was also concerned that once they started using a new compliance or policy management software, they would need to continue using it over the long haul, and that depended on its viability.

However, John felt reassured when he realized that SweetProcess allows you to download all your data for offline viewing in a few clicks.

In addition, he noticed that SweetProcess was easy to use, making adoption fast and easy. It didn’t take long for his team members to discover that it streamlines the onboarding process, even when their procedures witnessed a regulatory change.

Once John confirmed the usability of SweetProcess for his company, Liston Newton Advisory’s four directors received a proposal. After seeing a quick demo, John knew he had found the solution. He could see how much time and money the platform would save his company, making the decision a no-brainer.

Liston Newton Advisory now uses SweetProcess to find procedures using tags easily. They’ve organized everything into categories, making searching and locating what they need easy.

They also use SweetProcess to store company policies, like rules for taking time off, dress code, and reimbursement for studying. Before, these policies were only explained when someone new joined the company, but now they’re easily accessible in SweetProcess.

This has made the process of onboarding new employees much faster. All they need to do is log in to SweetProcess and show the new employees around. Liston also likes that SweetProcess allows him to use videos to explain procedures, which makes it easier for everyone to understand.

With the implementation of SweetProcess, Liston can now get a full oversight of what’s happening with the company’s processes and procedures whether it’s assigning tasks, the state of procedures, or KPIs that need to be hit by certain team members.

Liston no longer has to chase anyone down or send them a procedure to ensure compliance. He can see exactly how many procedures have been written, ensure that everything has been done correctly, and see how the admin team is doing things in case he feels anything can be done better.

SweetProcess makes it easy to comply with regulatory bodies by onboarding your staff members and keeping them in line with your company’s policies.

Benefits of Compliance Management System

A compliance management system can help you achieve many things in your business. Some of these benefits include:

1. Risk Mitigation

Compliance management is a quick way to find and prevent possible compliance risks and ensure your company is ready for whatever happens. By planning ahead, you can avoid falling victim to credibility loss or brand damage and legal fines.

2. Enhanced Trust

Stakeholders, like investors or customers, will always feel comfortable doing business with you because it serves as a trust seal. Or better yet, it’s an indicator that you’re willing to comply with regulatory bodies and won’t go rogue along the line.

3. Informed Decision-Making

It also ensures that whatever you do in your business as routine operations aligns with regulatory laws. This helps you avoid second-guessing, builds confidence, and speeds up decision-making.

4. Efficiency Gains and Scalability

A compliance management system helps you improve your business operations, removes process bottlenecks, reduces manual work, and boosts overall productivity.

5. Cultural Integrity

Having to enforce compliance in your business naturally promotes ethical practices and good conduct among your employees, thus creating a healthy work environment where everybody feels encouraged to give their best.

6. Cost Savings

Once your company adopts industry-compliant policies and culture, there is an almost zero likelihood you’ll have to pay any costly fines, penalties, or legal fees that come with non-compliance.

7. Enhanced Efficiency

Compliance management helps you optimize your workflows, boost operational efficiency, and increase profits.

8. Automated Processes

When your business operates, it’s easier to turn it into an automated process—especially now that compliance management tools like SweetProcess exist. You can streamline everything with a few clicks, ensure consistent compliance, and even free up time for your staff so they can focus on high-value activities.

You can even try Sweetprocess for 14 days free to determine whether it’s the right compliance management tool for your business.

9. Real-Time Monitoring

You must always monitor what’s happening in your business to stay compliant. Compliance monitoring can help you quickly find and fix any compliance challenges or business problems and resolve them before they get out of hand.

Approaches to Compliance Management

There are different ways to handle compliance in a company. Let’s go over the three best practices of compliance management:

1. Strict Top-Down Approach

This method allows top management and the compliance departments total control over compliance management. It encourages centralized decision-making and strict guidelines. But even though it speeds up decision-making, it can create a culture of fear, mistrust, and disconnection among company staff.

2. Hands-off Approach

In this case, company staff have the right to be in charge of compliance in their departments. This fosters employee empowerment and accountability. However, it can sometimes lead to inconsistent compliance practices and compliance breaches.

3. Shared or Distributed Approach

Unlike the first two approaches that prioritize one side, this method sees compliance as a collaboration between business managers, the compliance manager, and other staff members. It encourages shared responsibility, teamwork, and ownership. But at times it can lead to confusion and overlapping responsibilities.

Level up Your Company’s Compliance Management With SweetProcess

Compliance management is too important to be overlooked. Once you start documenting and streamlining your business processes to stay compliant, you will easily save legal fees, reduce routine errors, encourage ethical practices, improve employee performance, and ultimately boost your bottom line.

And with a compliance management software like SweetProcess, you have access to a user-friendly tool that allows you to:

- Document and manage your company’s policies in one place.

- Collaborate with your teammates, investors, and customers.

- Automate compliance tasks and workflows.

- Track and monitor compliance metrics and reports.

- Customize compliance process templates.

- Assign and track compliant tasks.

- Generate compliant procedures with AI.

Without having to pay anything, you can try SweetProcess for 14 days free to see if it’s the right tool for your business.