Last Updated on April 17, 2025 by Owen McGab Enaohwo

Every business seller envisions the day they finally secure the best deal and hand over the business to the right buyer. But let’s be real—selling a business isn’t always smooth sailing. You’ve probably heard stories of owners struggling to find buyers, facing endless negotiations, or walking away with less than they expected.

While the number of businesses bought and sold grew by 5% from 2023 to 2024, competition remains high, and only well-prepared businesses attract serious buyers. The difference between a business that sells quickly and one that stays on the market often comes down to strategic planning and documentation.

Buyers aren’t just investing in your brand. They want a well-structured, financially sound operation with clear records and scalable systems. Without organized financial statements, standard operating procedures, and a solid transition plan, it might take weeks or months to attract serious buyers.

The good news? With the right preparation, you can position your business for a successful, profitable sale.

This guide will walk you through the key steps and best practices for listing and successfully selling your business at its highest value.

Want to make your business more attractive to buyers? SweetProcess helps you document your workflows, streamline operations, and create a business that runs smoothly. Start your free 14-day trial today and set your business up for a successful sale!

Table of Contents

Pre-Sale Considerations: Steps To Prepare Your Business for Sale

During the Sale: Steps To Successfully Sell a Business

Post-Sale Considerations & Business Transition

How SweetProcess Streamlines the Business Sale Process

Selling a Business Like a Pro: Lessons From Founders Who Sold Their Companies Successfully

Make Your Business Ready for Buyers With SweetProcess

Why Sell Your Business?

Whether you’ve owned the business for a few months or several years, there comes a point where change becomes necessary. Maybe you’ve achieved everything you set out to do and want to step back. Maybe the market is booming, or personal circumstances are making you rethink your next move.

Every business owner is motivated to sell a business for different reasons. Let’s take a look at them:

Retirement or Lifestyle Change

After years of hard work, many business owners dream of stepping back and enjoying a well-earned retirement. Maybe you’ve built a thriving company, but now you want to trade the hectic schedule for a slower pace. Or perhaps you’re looking to spend more time with family or the freedom to travel without being tied to day-to-day operations.

For instance, if you started your company in your 20s, you might sell the business in your 60s or 70s to have more time with your grandkids. Selling to a new owner not only allows you to push the business forward but also secures your financial future while ensuring the company continues to grow under new leadership.

Market Conditions & High Valuation

The market changes depending on your company’s industry. An insight report by BizBuySell shows that in 2024, manufacturing, online and technology, and building and construction experienced the most growth in terms of acquisitions. For instance, the online and technology sector had a 74% increase in acquisitions.

If you’re in a booming industry, selling now could yield a significant return on investment.

Timing the sale of your business is crucial. Smart business owners capitalize on market trends to sell at peak value.

Financial Gain or Exit Strategy

Not every sale is driven by necessity. Sometimes, you simply want to cash out at the right moment. Maybe you built your business with the intent to sell, or you’re ready for a new investment opportunity. Selling a profitable business can free up capital to start something new, invest in real estate, or simply enjoy financial freedom.

For instance, a software entrepreneur might launch an app and sell the company to a larger tech firm once they gain enough subscribers. Taking advantage of such lucrative offers ensures you gain funds to launch the next startup or just to invest.

Business Struggles & New Opportunities

Statistics show that 20% of small businesses fail within the first two years. This data indicates that not every business owner sells from a position of strength. Some face financial struggles, declining revenue, or operational challenges that make it difficult to continue.

Instead of letting the business fail, selling to a new owner with fresh ideas and capital can be a strategic decision. For example, if you notice that your sales have declined, you could sell to another entrepreneur to rebrand the company and keep it going. In these circumstances, new leadership can strengthen the business.

Illness or Death

Life is unpredictable, and in some cases, health issues or unexpected circumstances force business owners to step away. When an owner can no longer manage the company due to illness or family emergencies, selling ensures the business continues without disruption.

For instance, if you are diagnosed with a chronic illness, the demands of managing staff, inventory, and operations can become overwhelming. Instead of allowing the business to suffer, you can find a buyer who can carry on your vision while allowing you to focus on your health.

Similarly, in the case of an owner’s passing, their family may not have the experience or desire to run the company. Selling ensures the business retains its value while providing financial security for loved ones.

Pre-Sale Considerations: Steps To Prepare Your Business for Sale

You’ve made your list of potential buyers and listed it online. But is your organization ready for the market? Selling a business is about making sure it is in the best possible shape. The more organized and well-documented your business is, the more attractive it becomes to potential buyers.

Here are the steps you can take to increase your business’s valuation and streamline the selling process:

Organizing Financial Records

Would you buy a business without knowing its income? Probably not, and neither will a potential buyer.

Having clear, up-to-date financial records is one of the most critical steps in preparing for a sale. Buyers will want to see records such as:

- Accurate profit and loss statements

- Tax returns

- Balance sheets

- Cash flow reports for at least the past three years

A buyer is far more likely to invest in a business with transparent, well-maintained financials because it reduces risk and uncertainty. Therefore, before listing the business, confirm that you have all the necessary financial information to present to the buyer.

Documenting SOPs & Operational Workflows

Every organization needs standard operating procedures (SOPs) and standardized workflows to operate smoothly. Imagine selling your 10-year-old marketing agency to another larger agency without documentation on critical business processes such as client onboarding, campaign management, and reporting.

The new owner will struggle to keep things running smoothly since they have to spend a lot of time during the transition learning more about the operational workflows. However, if you hand down written procedures with every workflow in detail, the buyer will be reassured that the business is a secure venture.

Enhancing Business Efficiency & Scalability

During the purchase, a buyer isn’t only looking at your business today—they’re also evaluating what it could be in the future. They are looking at:

- Is there potential to scale and open more locations?

- Are there opportunities to automate the existing business processes to be more efficient?

- Can the business scale without massive operational overhauls?

With this in mind, it’s essential to prepare your business to be more appealing. You could start by automating processes and investing in tools that boost efficiency to make the company more attractive to buyers.

Legal & Tax Considerations

Legal and tax issues can be deal-breakers. Before listing your business, ensure all contracts, licenses, and sales agreements are in order. Buyers will scrutinize everything from vendor agreements to employee contracts and intellectual property rights.

Additionally, selling a business can come with tax implications, depending on how the sale deal is structured. You can work with a financial expert to minimize liabilities and maximize profits to ensure you don’t face unexpected costs after the sale.

During the Sale: Steps To Successfully Sell a Business

Now that your business is well prepared for a sale, what should you do during the sale? With a strategic approach, you can get the best sale price and have a seamless transition. Follow these steps to navigate the sale successfully:

Step 1: Clarifying Your Selling Goals

Here are some questions to ask yourself during the sale:

- Are you looking for a quick sale, or will you wait for the right buyer who can maintain your company’s legacy?

- Do you want an all-cash deal, or are you open to financing options?

Defining your motivation early helps guide your strategy and expectations. For instance, a retiring business owner may prioritize a buyer who will uphold the company culture, while an entrepreneur exiting for financial reasons may focus on getting the highest bid.

Determining these goals helps you avoid rushed decisions and ensures the sale aligns with your needs.

Step 2: Obtaining a Business Valuation

You don’t want to sell your business at a loss or overprice it. Overestimating the company’s value leads to unrealistic expectations and difficulties in closing a deal.

To avoid such issues, work with a professional business valuator who can provide an objective assessment based on financial performance, industry trends, and market demand. Knowing your true worth helps you price your business competitively and attract serious buyers.

Step 3: Optimizing Business Operations

Does your business rely entirely on you as the owner to function? If this is the case, it might collapse once it changes hands because you don’t have solid business processes to keep it going.

Buyers prefer businesses with streamlined operations, documented workflows, and minimal dependence on the seller. During the sale, you can implement business process automation tools like SweetProcess to document your procedures, automate scheduling, and create clear employee roles. This way, the buyer sees the company as something they can easily step into and run.

Step 4: Understanding Risk Management

Selling a business comes with risks. You could encounter legal disputes, customer retention issues, or even employees leaving once they hear about the sale. Identifying and mitigating these risks early prevents last-minute roadblocks.

For example, a potential buyer might hesitate if your business relies heavily on a single client for revenue. If this customer pulls out, the business is at risk. In this case, you could diversify your customer base before selling to reduce dependency and strengthen your negotiating position.

Additionally, this is the ideal time to check your contracts, including regulatory compliance documents, and ensure that they are all updated. This approach eliminates legal complications.

Step 5: Marketing and Identifying the Right Buyer

Your business may take too long to sell because it’s listed on the wrong platforms. For instance, if you are a restaurant owner who wants to sell, you should target food industry investors, franchise operators, and chefs looking for ownership opportunities instead of listing on generic marketplaces.

Not every buyer is the right buyer. Some may lack the experience to sustain your business, while others might only be interested in acquiring your assets. Finding the perfect buyer means marketing your business strategically. This enables you to attract serious inquiries.

Step 6: Negotiation & Closing the Deal

The offer is on the table—now what? The negotiation includes:

- Deal structure

- Defining payment terms

- Transition support

You’ll also need to decide whether you’ll stay on for a few months to help the new owner settle in and how you’ll structure the sale.

Successful sellers enter negotiations prepared, understanding their non-negotiables while remaining flexible. A well-negotiated deal benefits both parties, ensuring a smooth handover and long-term success.

Post-Sale Considerations & Business Transition

As you sell your business, keep in mind that this transition affects employees, your finances, clients, and even your personal life. A smooth handover ensures that the company continues thriving under its new owner while allowing you to step away with confidence.

Here’s how to handle the transition effectively:

Handover Process & Knowledge Transfer

Imagine selling a thriving digital marketing agency you built from scratch. The new owner is excited, but they don’t know the ins and outs of client onboarding, campaign execution, or team workflows. Without a proper handover, they could struggle to maintain the company’s reputation.

This is where structured knowledge transfer becomes essential. Process documentation ensures that all key contacts, software logins, and operational workflows are readily available for the new owner. A well-documented handover package prevents disruptions and keeps the business running efficiently.

A tool like SweetProcess makes business process management seamless by allowing the seller to write step-by-step procedures that the new owner can easily follow.

Employee and Client Transition

A sudden change in ownership can create uncertainty, leading to key staff members quitting or loyal customers taking their business elsewhere. How can you prevent this? Here are some steps you can take:

- Be transparent and communicate the changes to the employees and clients.

- Introduce the new owner to reassure employees of their job security.

- Send an email to the customers about the sale.

- Host an introductory meeting for the clients to build trust and ensure continuity.

You can also stay on board for a few months to help with the adjustments. This approach is beneficial for businesses with long-term client relationships, such as consulting firms or service-based companies.

Managing Financial & Legal Finalization

Once you sign the deal, you still need to resolve financial and legal issues. These include taxes, outstanding invoices, employee benefits, and intellectual property transfers.

For instance, a software company founder might have patents and proprietary codes that need to be legally transferred to the buyer. Failure to do so properly could create ownership conflicts later. This is why it’s important to work with accountants and legal experts during this time to ensure that nothing is overlooked.

Financial Planning and Life After Selling a Business

What’s next after selling your business? Some entrepreneurs dive into new ventures, while others take time off or invest their earnings. Planning prevents financial uncertainty.

Let’s say you sell your business in a multi-million-dollar exit. Without a financial plan, you could easily overspend, make poor investment choices, and lose the wealth you’ve worked so hard to build. However, if you have a financial advisor to create a structured plan and allocate some funds for future investments, you can set up passive income streams.

How SweetProcess Streamlines the Business Sale Process

If you just met your potential buyer, can you hand them a well-documented system that shows every key process, or would you struggle to piece things together? Many deals fall through because businesses lack clear documentation, making them risky investments.

With SweetProcess, you don’t have to scramble to organize workflows or explain daily operations from scratch. It helps you automate SOP documentation, build a structured knowledge base, and seamlessly transfer processes during the transition.

Let’s explore how SweetProcess features can help you:

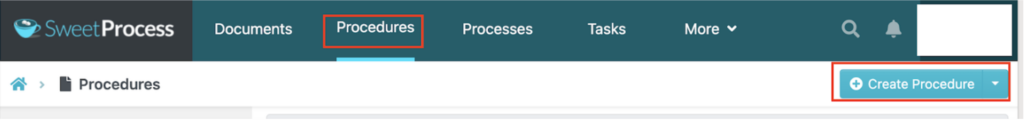

Automate SOP Documentation with SweetAI

Manually documenting SOPs can be time-consuming, but SweetProcess’s AI-powered documentation tool —SweetAI—simplifies the process.

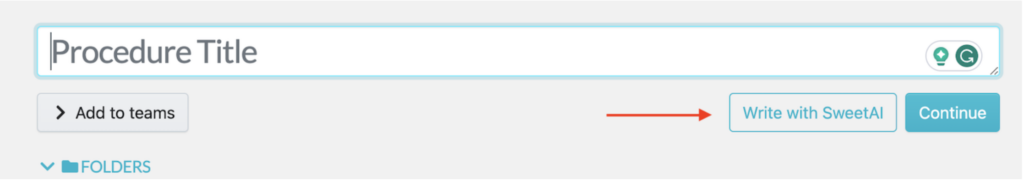

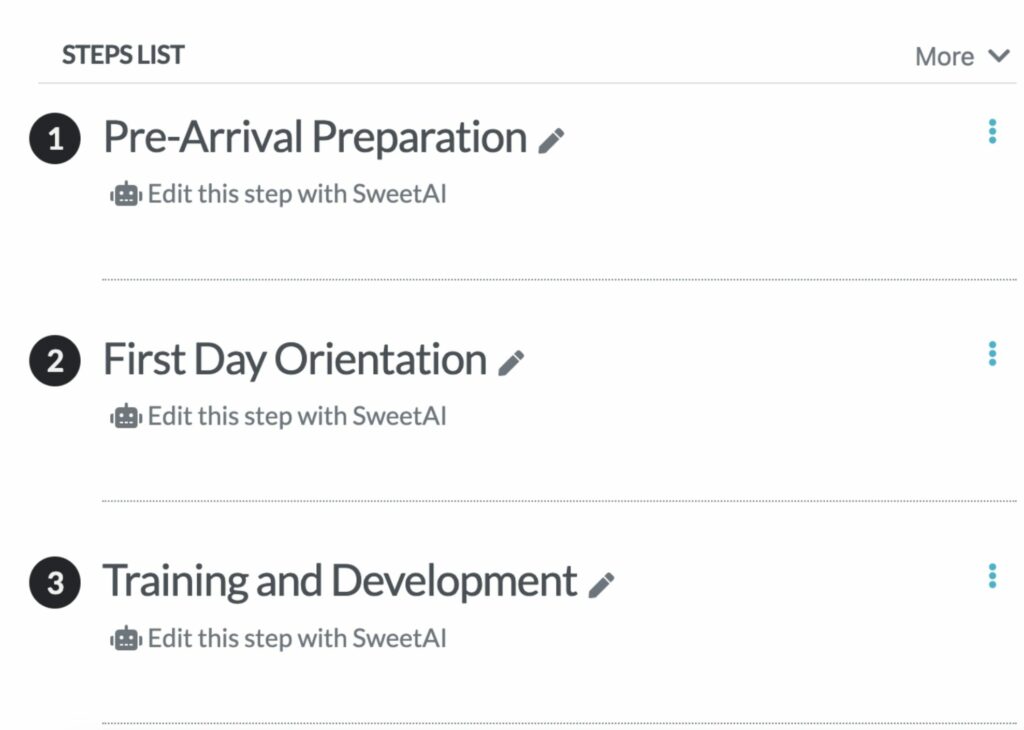

Instead of spending hours writing detailed SOPs, you can input your title and key business functions, and SweetAI will generate step-by-step instructions in seconds. Here’s how:

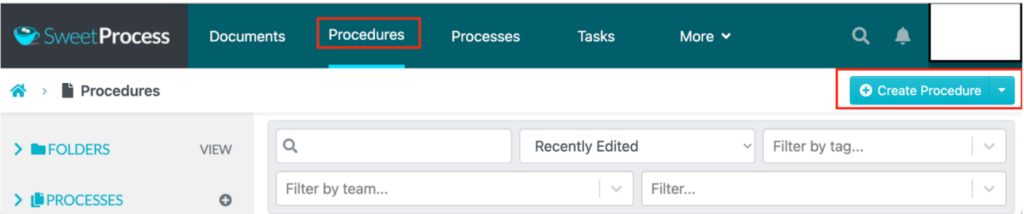

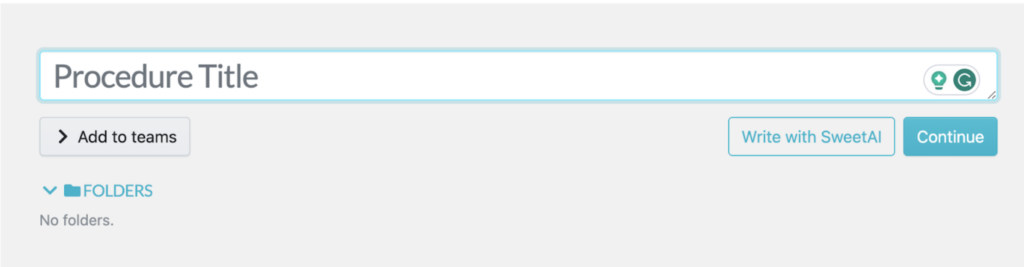

- Log in to your SweetProcess account and tap the “Procedures” tab.

- Give your new procedure a title.

- Click the “Write with SweetAI” button.

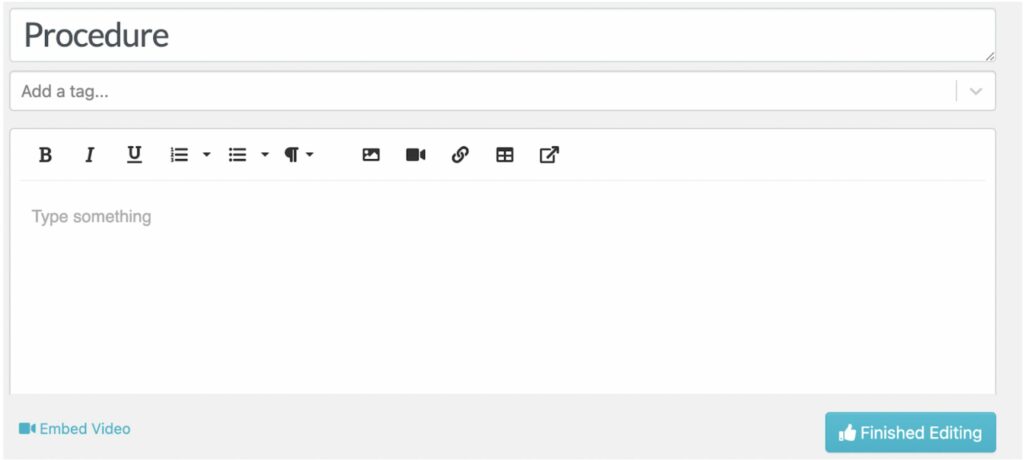

- The text will be generated based on your title. You can click the pencil icon to make changes and update your procedure.

- Additionally, you can scroll down to the steps section and edit them according to your company’s needs.

Build an Internal Knowledge Base for Seamless Knowledge Transfer

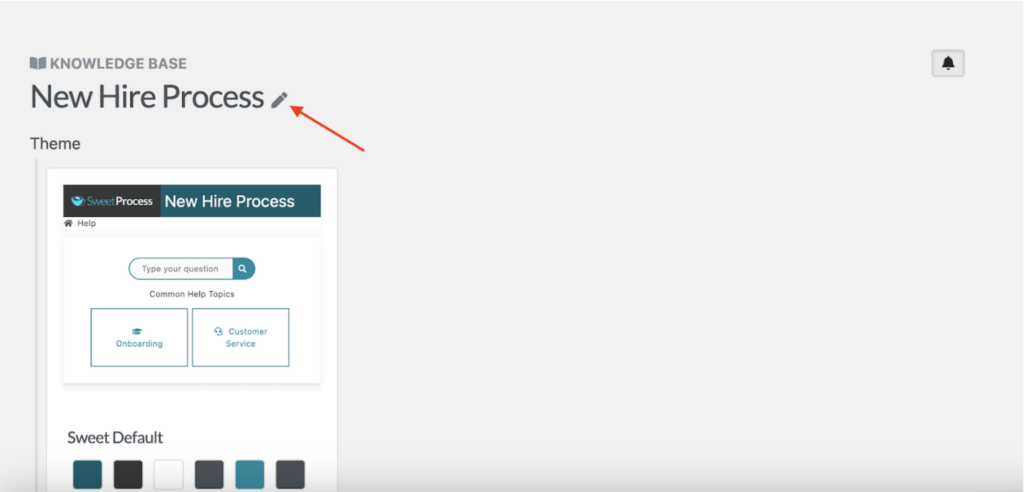

Buyers want a business that doesn’t rely solely on the previous owner’s expertise. SweetProcess allows you to create an internal knowledge base, ensuring that all critical information is centralized and accessible.

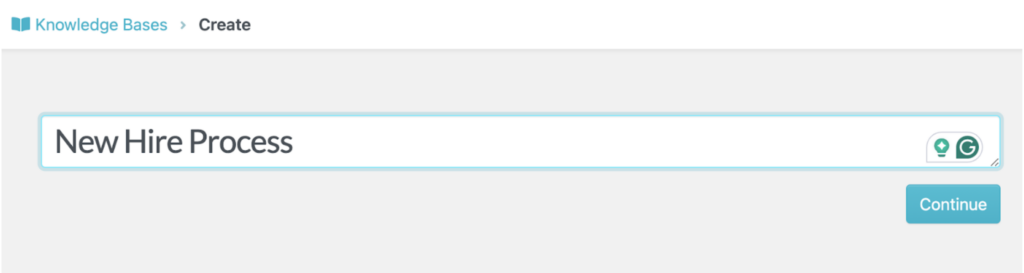

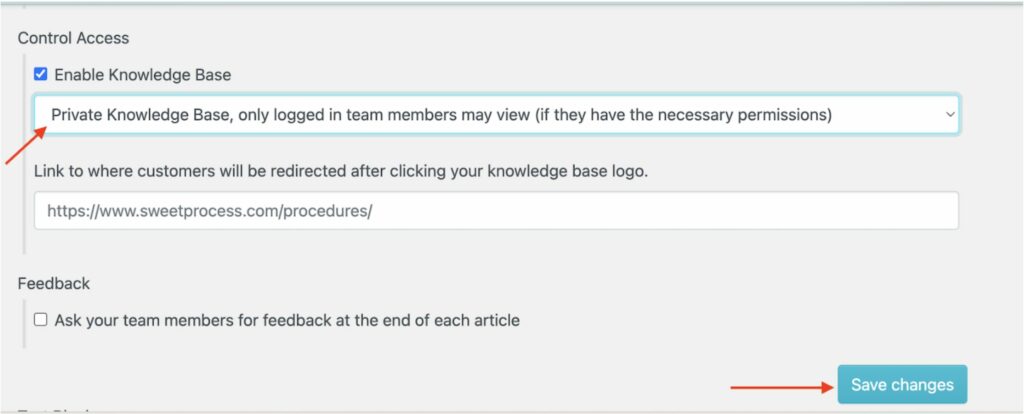

This knowledge base is useful for businesses with recurring clients or technical operations that require specific guidelines. Follow these steps:

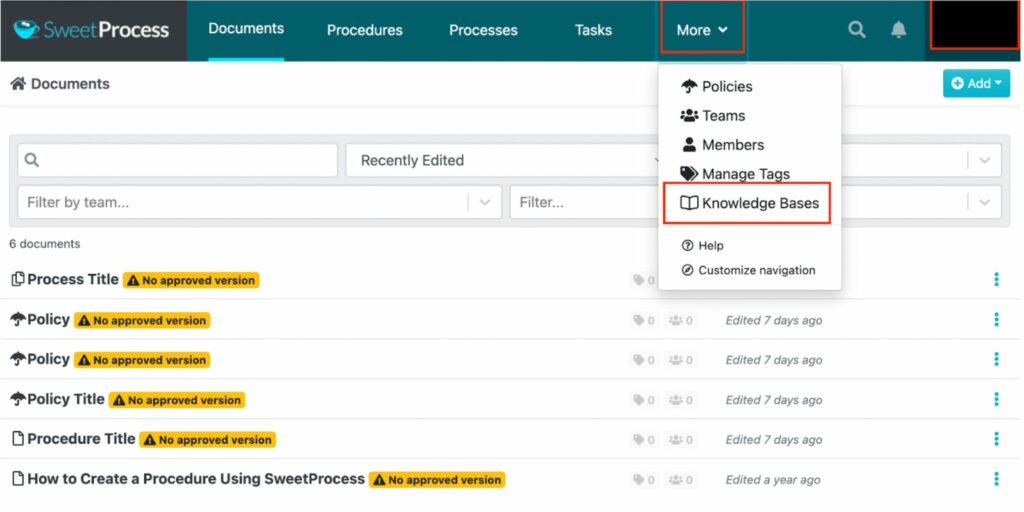

- Click on the “More” tab and select “Knowledge Bases.”

Enter a knowledge base title.

- Add details to make your knowledge base more comprehensive. Click on the pencil icon to make edits.

- Since the knowledge base is internal, scroll to the “Control Access” section and check the box to make it private.

- Click “Save” to apply the changes.

Create Processes From Existing Company Procedures

Many business owners already have informal processes in place, but they may not be documented. SweetProcess allows you to turn existing company procedures into structured, easy-to-follow workflows.

You can standardize all the processes to keep the entire company on the same page before selling. Here’s how to use SweetProcess for this task:

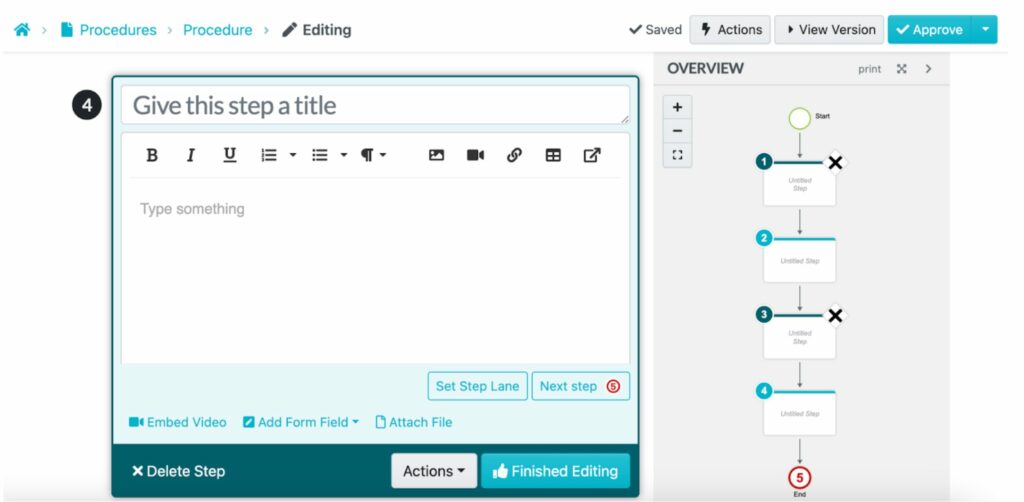

- Open the “Procedures” tab and then select “Create Procedure.”

- Enter your title.

- Add more information to your procedure.

- Add steps and information about your process.

Edit Procedures and View Version Histories

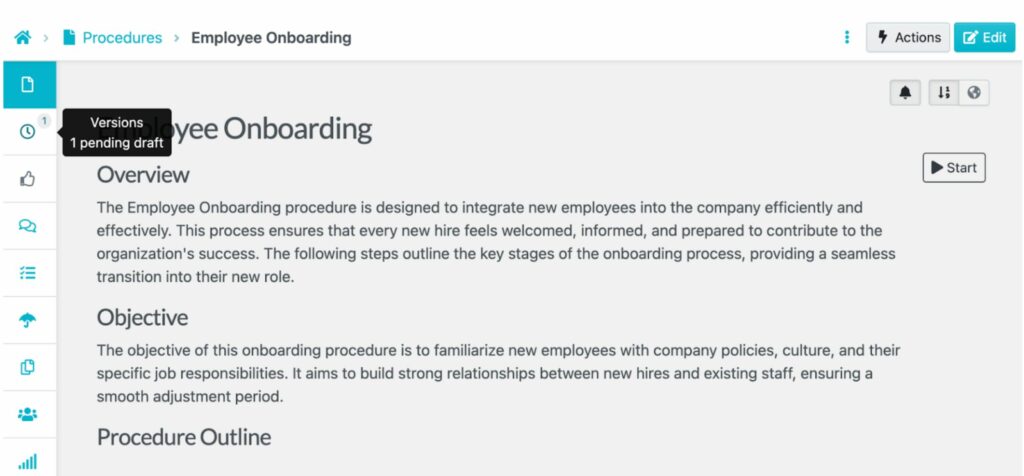

SweetProcess makes it easy to edit existing procedures and track version histories, ensuring that all updates are well-documented.

This is crucial during a business sale, as buyers need to see how processes have changed over time and ensure they receive up-to-date documentation. Here’s how to track versions in SweetProcess:

- Open the procedure and hover over the left sidebar menu.

- Click on the clock icon to view version history.

You can retain the current version or view the previous ones.

Manage Processes, Procedures, and Policies in One Place

One of the biggest challenges during a business sale is keeping everything organized. SweetProcess acts as a centralized hub for managing SOPs, policies, and processes, allowing buyers to access everything in one place.

Rather than handing over scattered documents, emails, and PDFs, sellers can give buyers a single source of truth for all business operations.

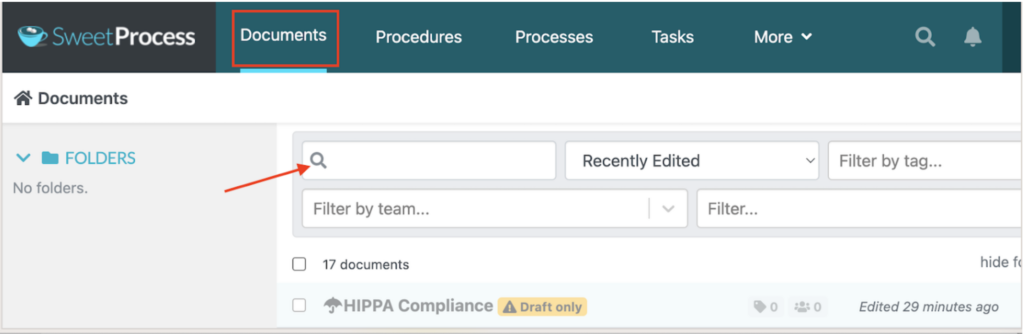

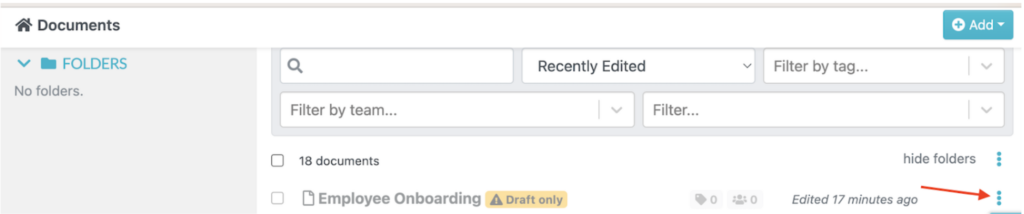

From the SweetProcess dashboard, you can view all your processes, policies, and procedures and choose to edit, share, or delete them.

- Open the “Documents” tab to see the list.

Use the search button to locate a specific process, procedure, or policy.

- Once you find your document, click on the three dots on the right side and select an action.

SweetProcess’ features have made it popular among business owners.

One of them is Good Nature Organic Lawn Care, a U.S.-based company specializing in organic lawn care solutions. As the company grew, documentation and process management became major pain points. The company relied on printed manuals to guide employees, but these manuals quickly became outdated as processes evolved.

Employees often overlooked them, leading to inconsistencies, inefficiencies, and costly errors. The lack of a streamlined system also made training new hires time-consuming. Alec McClennan, the CEO, realized he needed a better solution after seeing a friend use workflow management software. After researching options, he chose SweetProcess for its simplicity and effectiveness.

Here are the key benefits the business gained from SweetProcess:

- Simplified employee onboarding: New hires could now access training materials easily, reducing the learning curve.

- Effortless business process documentation: Updating processes became quick and seamless, eliminating the constant need for new printed manuals.

- Standardized operations: Employees followed clear, up-to-date procedures, reducing errors and ensuring consistency.

- Scalability: With structured workflows, the company started growing efficiently without operational chaos.

Another company that benefited from SweetProcess is the automotive advertising agency Mudd Advertising, which has served over 3,000 dealerships annually for more than 30 years. Without a system, operations were chaotic, leading to inefficiencies and costly mistakes. Employees relied on word-of-mouth instructions, making it difficult to track workflows and maintain consistency.

When Dave Meindl joined Mudd Advertising as senior advisor of digital technology and performance, the company lacked documented processes. He recognized the need for structure and implemented SweetProcess to improve efficiency.

Dave worked with his team to outline key steps for each process, continuously refining them based on real-time feedback. Here are the benefits from this switch:

- Improved efficiency: The standardized workflows reduced confusion, minimized errors, and enhanced collaboration.

- Cost savings: The avoidable expenses due to inefficiencies and mismanagement were significantly reduced.

- Reliable reference system: Employees could access documented processes instead of constantly seeking guidance.

- Faster onboarding: New hires could quickly learn tasks without extensive training, freeing management time.

Selling a Business Like a Pro: Lessons From Founders Who Sold Their Companies Successfully

Even the most prominent business owners make mistakes when it comes to selling their companies. However, there are a few who have mastered the art of selling, ensuring smooth transitions and maximum value. Here are the best practices derived from seasoned entrepreneurs who have navigated this process:

Valuation Best Practices

Understanding your business’s worth is crucial for a successful sale. A well-prepared valuation ensures you attract the right buyers and helps secure a competitive price. Some of the best practices to help maximize your company’s value before selling are:

- Early exit strategy planning: Richard Harpin, the founder of HomeServe, emphasizes the importance of planning an exit strategy early in the business lifecycle. He advises business owners to consider a mini-exit to boost confidence and alleviate financial concerns, ultimately enhancing business value.

- Use multiple valuation methods: You can also combine different valuation methods to get a more accurate and fair market price.

A notable example is Fox Corp.’s strategic sale to Disney in 2019, in which it sold several entertainment properties while retaining ownership of its broadcast networks, including Fox News Channel, Fox Business Network, and Fox Sports. This exit strategy was well executed to help the owners cash out early due to increased competition from Netflix, Apple, and Amazon, which had more capital.

Best Practices in Finding Buyers

Finding the right buyer can make or break a deal. Whether through direct outreach or working with professionals, targeting the right audience ensures a smooth and profitable sale. Here are ideal strategies for connecting with potential buyers

- Leverage direct outreach: You can reach out to direct buyers who could be ideal for your business continuity.

- Engage advisors: Experienced advisors will help identify qualified buyers, negotiate favorable terms, and manage due diligence efficiently.

A good example of a company that used direct outreach is Wingstop UK founders, who introduced the American brand Wingstop to the UK market. After building a strong brand, they sold the franchise to the American private equity firm Sixth Street for over £400 million.

The CEO, Chris Sherriff, emphasized the strategic alignment of the sale: “This is a major step in our journey as we build the pre-eminent fast-casual restaurant brand in the UK and Ireland….The partnership with Sixth Street represents an excellent strategic and cultural fit for Wingstop UK. Together, we are excited by the expansion opportunities ahead while retaining our unwavering focus on youth culture and the communities we serve.”

This transaction is one of the most significant in the UK’s fast-paced y’all dining sector, reflecting the brand’s substantial growth and popularity.

Best Practices Regarding Legal Considerations

Legal complexities can slow down or even derail a sale. Proper preparation, due diligence, and tax planning help protect both parties and ensure a compliant, profitable transaction. These legal best practices will keep the process efficient and secure:

- Preparing comprehensive due diligence documents: Having updated financials, contracts, and compliance records streamlines the sale process and builds buyer confidence.

- Structuring the deal to minimize tax burden: Consult tax professionals to ensure that the sale structure optimizes financial outcomes.

For instance, Microsoft acquired Activision Blizzard in October 2023 for $68.7 billion. However, this deal took over a year to complete due to legal concerns by regulatory bodies about potential monopolistic practices and competition. The Federal Trade Commission (FTC) and the UK’s Competition and Markets Authority (CMA) had to approve the merger after concessions were made.

To gain approval, Microsoft committed to keeping popular titles available on multiple platforms and agreed to offload some cloud gaming rights to Ubisoft.

Best Practices in Business Transition

A seamless transition maintains business continuity and protects your legacy. These practices can ensure key employees stay and operations run smoothly after the sale. These strategies will help ease the handover process:

- Operational continuity: Documenting processes and business continuity plans helps new owners seamlessly take over without disrupting business operations.

- Retain key employees temporarily: Offering incentives for leadership to stay on post-sale ensures a smoother handover and business stability.

During the acquisition of Time Warner, the chairman and CEO, Jeff Bewkes, remained the senior advisor to help the AT&T team with the transition.

The chairman and CEO of AT&T Inc., Randall Stephenson, had this to say about the move: “Jeff is an outstanding leader and one of the most accomplished CEOs around. He and his team have built a global leader in media and entertainment. And I greatly appreciate his continued counsel.”

Make Your Business Ready for Buyers With SweetProcess

A well-organized business is a more valuable business. Buyers don’t just look at revenue—they look at how smoothly a company runs. If your operations are chaotic or rely too much on undocumented knowledge, you risk losing potential buyers or lowering your valuation.

However, with SweetProcess, you can create a business that runs on clear, documented workflows. You can standardize your processes and procedures, making your company more efficient, easier to transition, and more appealing to buyers.

The centralized knowledge base is an excellent reference point for all company documentation.

Show buyers your business is built to last. Sign up for a 14-day free trial of SweetProcess today and start building a system that drives long-term value.