Last Updated on April 17, 2025 by Owen McGab Enaohwo

![How to Write Bank Policies and Procedures [Actionable Tips + Examples]](https://www.sweetprocess.com/wp-content/uploads/2024/07/bank-policies-and-procedures.jpg)

Policies and procedures are too important not to be included in your organization. They tell everyone practically everything they should know about your business and ensure everyone is on the same page.

Ignorance is no excuse for the law. Imagine two of your employees making blunders. You look at both and see you could manage the first error because it wasn’t costly. But the second would cost you.

How would you face this? Both didn’t know of the existence of the policies and procedures to guide them. In this case, ignorance could excuse both of them, but what about you? You’ll be held responsible because you didn’t inform your employees about your bank’s policies and procedures.

In this guide, you’ll learn how to write bank policies and procedures the right way. You’ll also learn how to prepare them in a way that makes your employees interested in reading them and having fun doing so as well.

Spoiler alert: SweetProcess is a tool that makes this activity more accessible and fun for everyone. Sign up for a free trial to get started on sorting your policies and procedures. You don’t need a credit card.

Table of Contents

What Are Bank Policies and Procedures?

Why Bank Policies and Procedures Are Important

How to Develop Bank Policies and Procedures: Step-by-Step Guide

How to Create Bank Policies and Procedures Using SweetProcess

14 Actionable Tips to Keep in Mind When Writing Bank Procedures

11 Actionable Tips to Keep in Mind When Writing Bank Policies

Develop Your Bank’s Policies and Procedures Using SweetProcess

What Are Bank Policies and Procedures?

Policies and procedures make a difference in an organization. If all employees are on the same page, the organization can operate smoothly and effectively.

Policies and procedures are formal guidelines that outline an organization’s members’ actions, behaviors, and processes. Although these terms are sometimes used interchangeably, they mean different things.

What Are Bank Policies?

Policies are general guidelines that outline your organization’s plan for dealing with specific issues. They are high-level principles that clarify an institution’s culture. Policies shape decisions by providing structure for the firm’s daily activities.

Policies communicate an organization’s values, philosophy, and culture. A good company policy helps promote fair treatment and employee wellness and ensures that regulations and laws that govern these matters have been obeyed. With policies, management can communicate its commitment and expectations regarding compliance.

Policies of a bank can include a well-written document that will help to protect the rights of the employees and the interests of the institution, as well as matters of safety, health, employee accountability, legal compliance, employee benefits, code of conduct, confidentiality agreements, customer service policies, etc. For instance, financial institutions should make sure of regulatory compliance policies and procedures to protect consumers and manage their risks.

What Are Bank Procedures?

In a broad sense, procedures are simply detailed instructions that tell readers the best way to perform a task. They show the method for completing something with steps and instructions for each aspect of the task.

Procedures are written as specifically as possible so employees can follow them easily. Different methods can apply to each part of a business.

Bank procedures are guidance provided by management for employees on how to complete transactions and processes. They are designed to assist an institution in succeeding and following regulatory and legal requirements.

A procedure helps employees check human error and consistently complete tasks correctly. It also lets you improve your team’s efficiency and accuracy when completing recurring tasks. This way, there’s not much difference between a new employee and a veteran.

Why Bank Policies and Procedures Are Important

Just in case you aren’t entirely sold on the idea of having policies and procedures, this section covers more reasons why bank policies and procedures are important. From helping workers achieve efficiency to avoiding legal cases, the worth of policies and procedures can’t be ignored.

Helps you comply with regulations

Every industry has its rules and regulations that all participants must adhere to. Compliance with regulation is a significant reason bank policies and procedures are essential. Banks and financial institutions are subjected to rules and laws that govern their operations, and violating some of them causes too much trouble you don’t want.

Ensure clarity

Policies and procedures are essential for banks to ensure that employees have clarity and a consistent approach. With these documents, your employees can understand what actions could see them violate the law and if they would breach internal policies. This clarity is especially beneficial in client management, ensuring seamless interactions and fostering trust.

Build consistency

Policies and procedures enhance consistency by ensuring everyone working on a particular process produces the same outcome. Consistent products and services can help attract and retain customers and allow your business to develop a reputation for high-quality performance.

Leads to continuous improvement

When instructions are written down and followed in a business, you can easily picture how organized the place will be in addition to steady growth. Policies and procedures can help optimize your teams’ and organization’s productivity by streamlining decisions. Where productivity increases, of course, an increase in revenue and profitability follows.

Enhances operational efficiency

Team members who employ procedures will improve accuracy, as they have specific steps and guidelines to follow. Policies and procedures are a sure way of repeating successful steps and reducing the risk of errors. This can help you grow your business and increase efficiency.

Helps with employee training and development

Procedures can help new team members learn processes and systems. Human resource teams may provide procedures during the onboarding process or include standard methods in the employee handbook. Having policies and procedures not only provide compliance guidance to your staff but can also empower them by giving them a framework that ensures they do the right thing by being aware of the bank’s commitment to fair lending practices.

Faster training

Having your policies and procedures documented makes training new and old staff much faster. Your new employees won’t have to walk on eggshells their first few months because they fear making errors. Rather than asking questions even for the littlest things, new employees can help themselves by referring to compiled manuals. This method saves time. Also, learning can be less tedious when employees feel confident.

Coherent decision-making

When policies and procedures outline values, priorities, and processes, it can make it easier for individuals and teams to make critical business decisions. Your policies and procedures manual already contains all the important frameworks of your organization, making it easy to review them quickly to improve your company’s affairs.

How to Develop Bank Policies and Procedures: Step-by-Step Guide

Developing the necessary policies and procedures for your financial institution is a process that should be done painstakingly. Adequately done work ensures that you can communicate typically complex laws and regulations to your banking employees in a way they can understand.

Step 1: Assess the current situation in your bank

When you begin writing policies and procedures, it will make sense to examine your existing ones if you want to improve them. Examine them to understand the gaps, issues, and opportunities for improvement.

Take note of any legal or regulatory requirements you must follow. They may regulate specific policies and procedures, such as an accrediting or oversight group.

Step 2: Define the objectives and scope

Next, state clearly what you want to accomplish by defining the specific objectives and scope of the new or revised policies and procedures, which should be clear and comprehensive. Consider your overall business objectives, then determine how each department and individual roles contribute to those goals.

Step 3: Brainstorm tasks and processes

Next, examine your organization and what needs to be written as a policy or procedure. Consider your organization’s goals, challenges, and industry best practices for guidance.

Step 4: Write the procedures and policies

Next, write your procedures and policies according to your organization’s scope and objectives. You can do this collaboratively by working in a group setting and determining the most appropriate language for each policy and procedure. Alternatively, you could delegate certain policies and procedures to specific groups or departments, depending on their function in your company.

Step 5: Review and approve the policies and procedures

When you’ve written a draft of your policies and procedures, proofread carefully and revise as necessary before implementing them. Ask others to review your document and suggest changes if required. You should check for accuracy, completeness, relevance of the content, clarity, consistency, readability of the format and language, and alignment with the objectives and scope of the policies and procedures.

Step 6: Set up an implementation plan

After approval, implement and communicate the policies and procedures to your employees. This involves distributing, publishing, and displaying the policies and procedures in accessible and visible ways, such as on the bank’s website, bulletin boards, manuals, newsletters, and software like SweetProcess.

Step 7: Ensure policies and procedures are easy to find and access

It is one thing to develop comprehensive policies and procedures and another to get it to your employees. Employees who don’t use the provided documents are almost less effective and can hurt the company’s goals. This is why, on your part, you need to ensure your policies and procedures are easy to find and access. Having a centralized location where these documents are kept is essential. Software like SweetProcess makes it easy for employees to call up a particular section of your policies or procedures they’re interested in with just a few commands.

Step 8: Have employees acknowledge compliance policies

You want to ensure your employees are accountable as you distribute your policies and procedures. You can do this by having them sign and acknowledge that they have read, understood, and agree to abide by particular policies and banking procedures. This should be done annually and when a policy or procedure is updated. This can save you if an ugly situation arises because your employees can’t claim they didn’t know what was expected of them since they acknowledged that you provided them with information.

Step 9: Regularly review and improve the policies and procedures

Your prepared policies and procedures are not everlasting. Periodically, you will change them to keep up with regulations in the banking industry and drive optimum performance. Besides that, you’ll need to monitor and evaluate your existing policies and procedures to measure their performance, impact, and outcomes.

This step will require you to collect, analyze, and report data and feedback regarding the implementation, compliance, and results of your policies and procedures.

How to Create Bank Policies and Procedures Using SweetProcess

SweetProcess is a policy and procedure documentation software suitable for all businesses, including your financial institution. It is easy to use and solves all of your documentation problems. Its features have been developed not just for their own sake but for the reason behind them.

It has a policy and procedure documentation feature that you can explore manually or use our Sweet AI to aid your writing process. There’s also a tracking feature to see who’s reading or working on a process, reminders for updates and task completion, a comment feature to foster teamwork, task assignments, notifications, integration with your favorite apps, revision history, private access to keep your work secure, import and export feature.

In a nutshell, SweetProcess is one of the best software programs for improving efficiency in operations and ensuring compliance management and implementation in your institution.

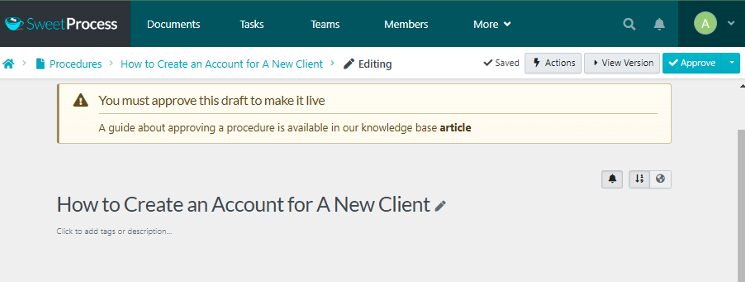

How to Create a Procedure in SweetProcess Manually

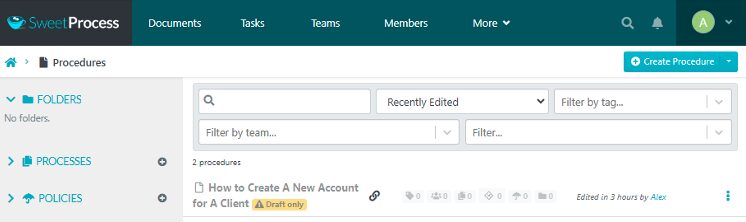

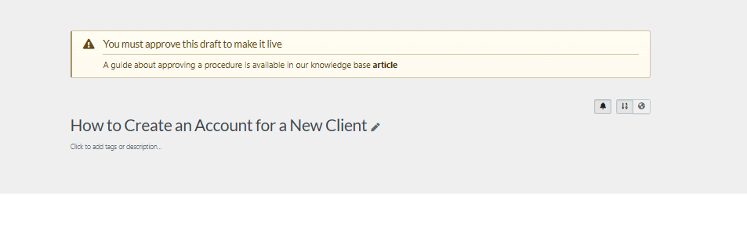

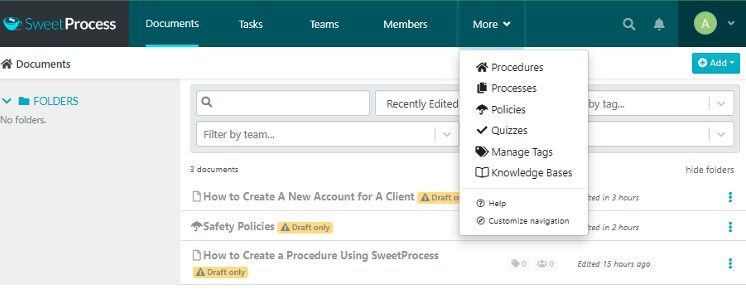

Click on “Procedures” and then click on “Create Procedure.”

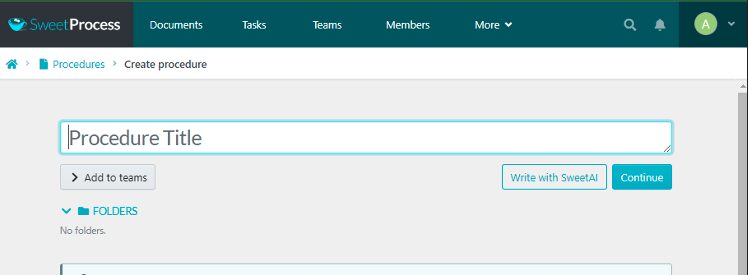

Give your procedure a title and click on “Continue.”

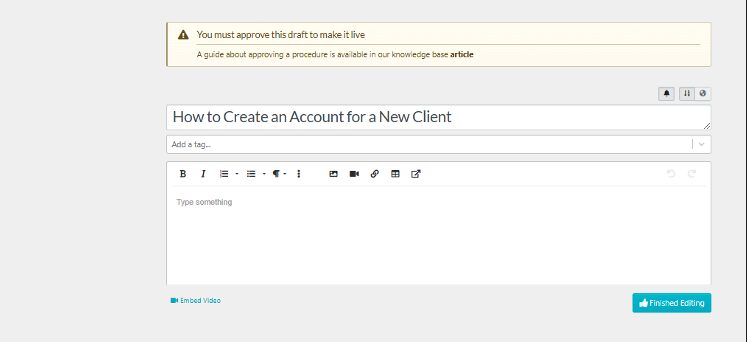

Click on the pencil symbol beside the title.

Fill out your procedure details and click “Finished Editing.”

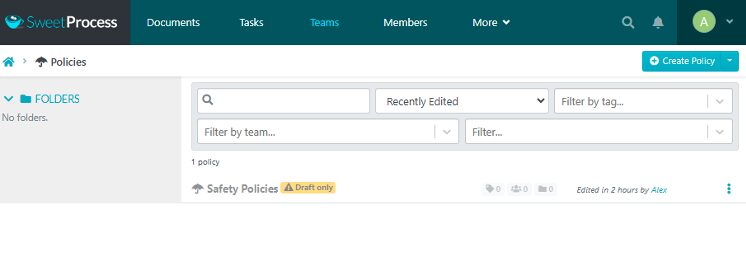

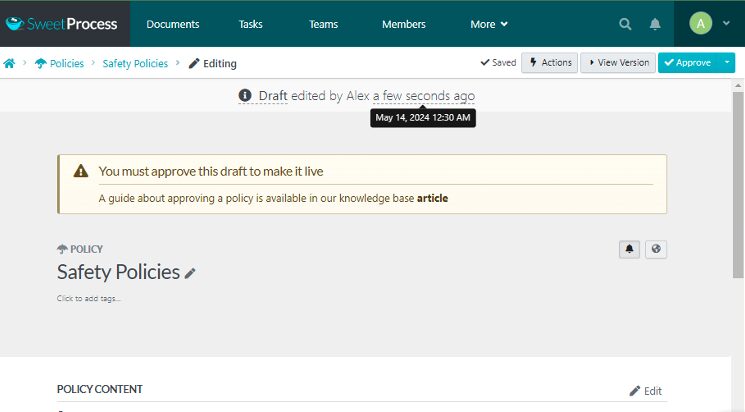

How to Create a Policy in SweetProcess Manually

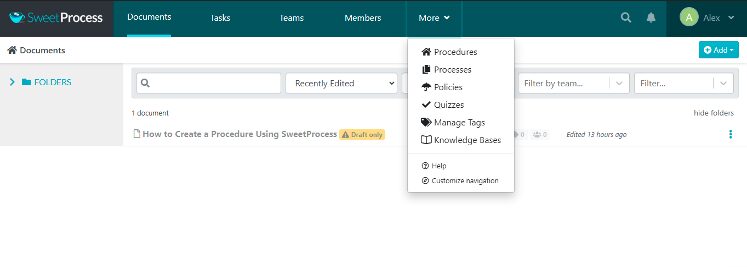

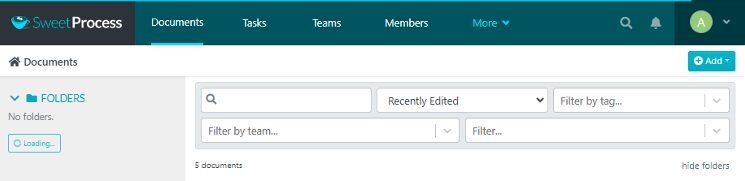

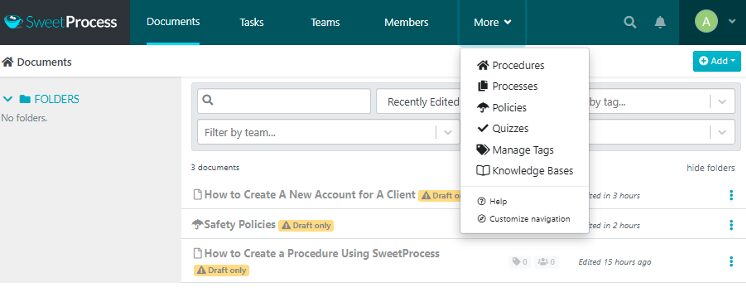

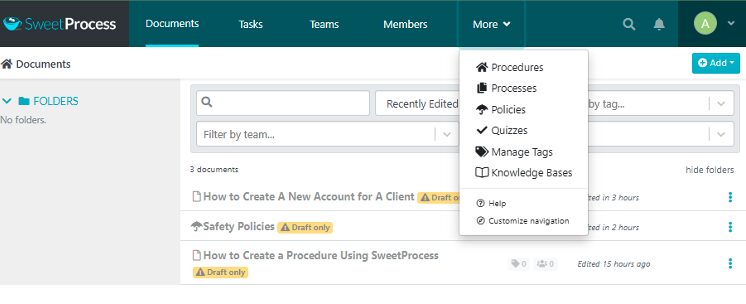

Click on “More.”

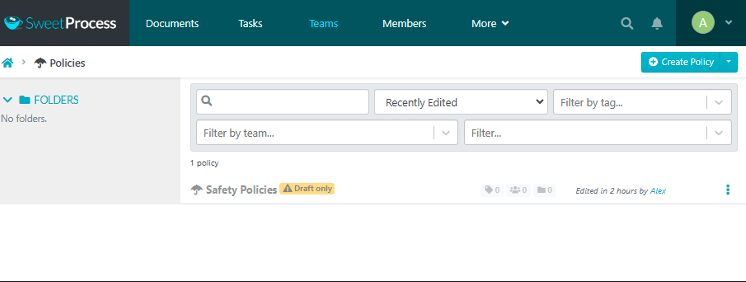

Select “Policies.”

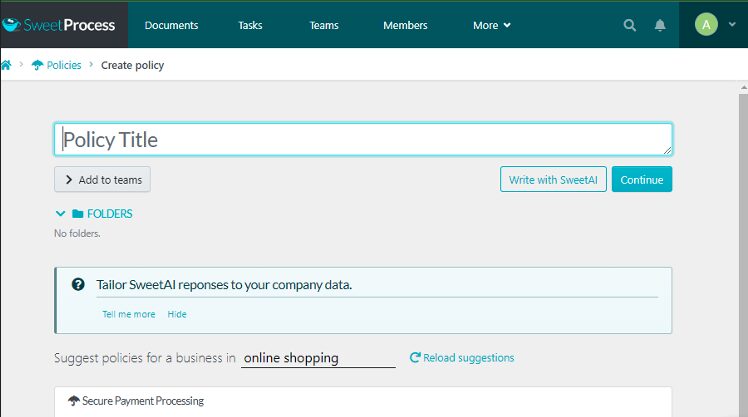

Click on “Create Policy.”

Give your policy a title and click on “Continue.”

Click on the pencil icon to build your policy.

Fill in the necessary details of your policy and click “Save changes.”

How to Create a Procedure in SweetProcess Using AI

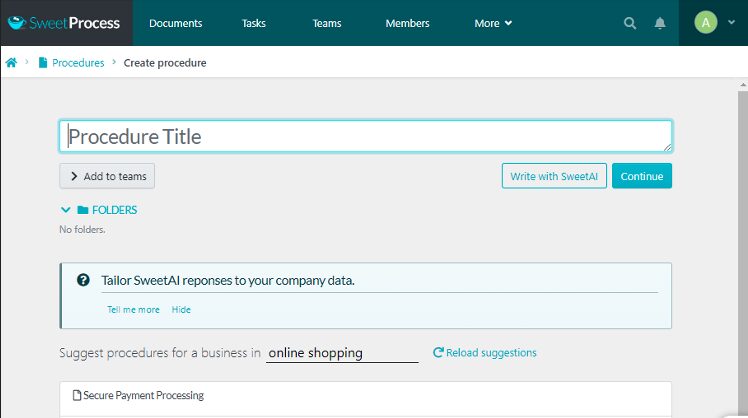

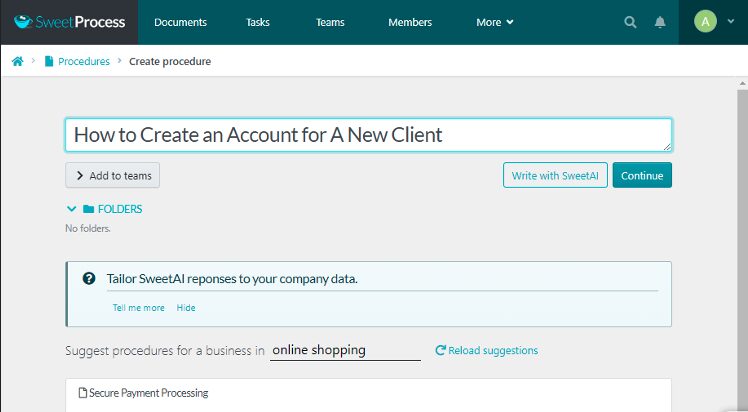

Click on “Procedures” and then click on “Create Procedure.”

Enter the procedure title and click “Write with SweetAI.”

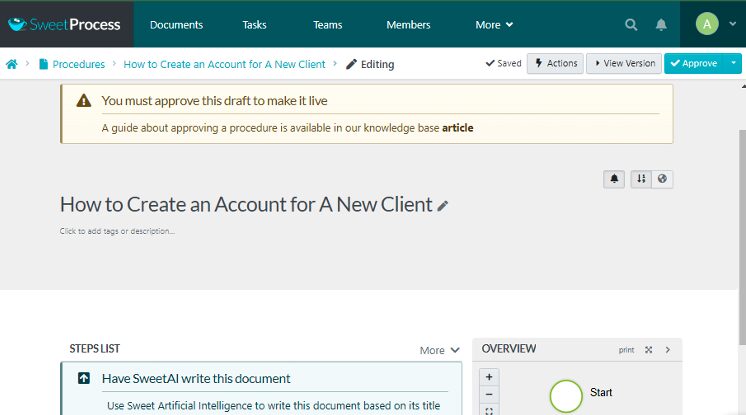

Click on the pencil icon to edit the content to suit your style.

Click on “Approve” to publish the document.

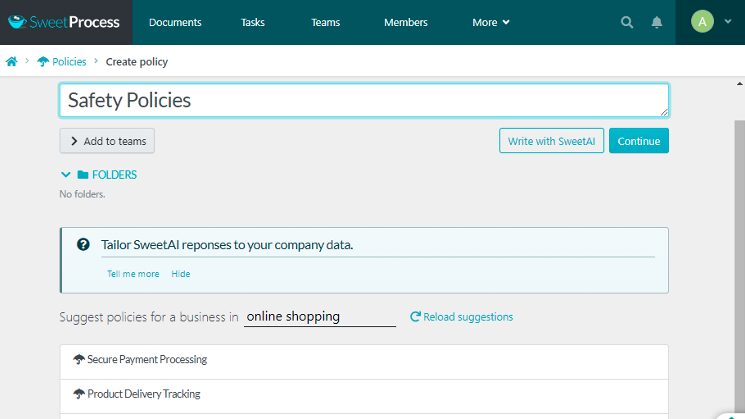

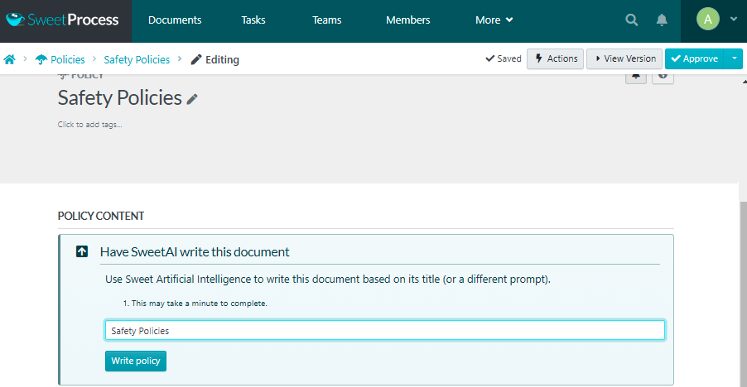

How to Create a Policy in SweetProcess Using AI

Click on “More.”

Select “Policies” and click on “Create Policy.”

Enter the policy title and click “Write with SweetAI.”

Click on ‘’Approve’’ to publish the document.

Besides the unbelievably simple yet rounded nature of SweetProcess, here’s why you can put your money on SweetProcess for your documentation. Sarah Brenner, the director of quality assurance at Belvidere Community Unit School District 100, experienced firsthand the frustration of having helpful information documented that no one uses.

Yes, she had Google Docs containing processes and procedures, but they were nightmares for her team. It was hard to find specific documents because they weren’t organized, and her team didn’t use them. Information was not easily accessible to stakeholders, especially the parents and guardians of the students.

This was the story for a while, with “efficient” being a scarce word to describe her team. The story changes when she decides SweetProcess is the one after going through other alternatives. Employees are happier and more efficient than ever. There are no more worries about onboarding new employees, mixing up steps, or spending hours searching for a policy or procedure.

When you aim to provide your customers with the best property management services, it can be disheartening to see the opposite happen. This was the case of Perry Beebe, the managing director of All Residential Real Estate.

Being in an industry that regularly updates its policies means one has to be prepared to capture such changes—not with a pen and paper, though. Perry found that to be ineffective, and it cost him customers.

Choosing SweetProcess among the hundreds of software programs on the market has proven to be one of the best decisions he made for his business. His happy and satisfied customers cement his position.

The trouble of working with quickly outdated tools and leaving team members with inadequate information is over, and his employees perform their roles efficiently. Your financial institution can take a good turn, too, when you decide to use SweetProcess. A free trial is all you need, so sign up here.

14 Actionable Tips to Keep in Mind When Writing Bank Procedures

In this section, we’ll write your bank’s procedures. Still, remember what policies are? Right, here are the guidelines for completing a task/process. These tips below will help you develop your procedures seamlessly.

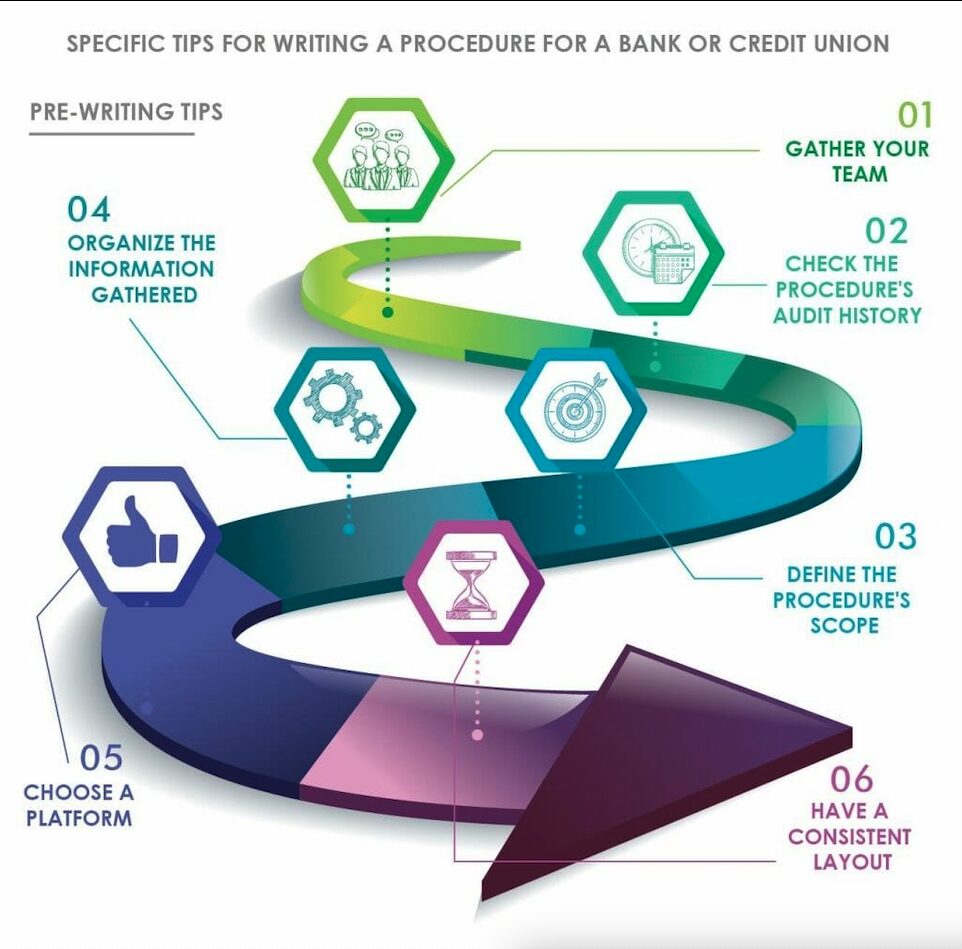

1. Gather your team

Before you start writing, gather a team of experts for the procedure you’re working on. Contact those who already know how to complete the task since they likely possess tribal knowledge; they’ll have detailed steps and advice for improving a process. Together, you can gather data for the procedure.

2. Review current procedures

Your company may have procedures it currently uses. Consider reviewing the current procedure documents when writing your own. If this is the case, you only have to review and improve the current procedure related to a similar task. This can help you determine which layout and structure work best for your company.

3. Define the procedure’s scope

There will be many processes in your financial institution that will need different procedures. Be focused and work on one at a time. First, consider which one you want to begin with. You may prioritize writing a procedure for a necessary process, or you can begin writing procedures by starting with a more minor task.

4. Choose a platform to work with

You can choose from a variety of formats when drafting a procedure. You may use a software program, a word-processing document, or a pen and paper. Fortunately, there are different platforms besides Google Docs and Microsoft that you can use to document your procedures.

These platforms are more streamlined, with your organization’s needs in mind. SweetProcess, one such platform, is a reliable tool for financial institutions. You can easily write, categorize, search, and keep track of your procedures, and employees can better comply with written policies and Federal Savings Association regulations.

5. Have a consistent layout

Your organization’s style and the procedure being written will determine how information is displayed. More prolonged procedures can be in an instruction manual format, while short procedures can be in a checklist structure. This will facilitate understanding and adherence to investment and credit policies and Bank Secrecy Act regulations.

You can also use instruction manual templates that are consistent with the document you want to create.

6. Use a short and engaging introduction

Your introduction is a vital part of any procedure. Short introductory paragraphs introduce your employees to the topic and keep them interested. Include who should follow the procedure and when. You may also include information about why the procedure is important and how it can help your team members. Remember that your introduction can motivate your readers to read the whole document.

7. List every required resource

Right after the introduction, list any resources or materials an individual will need to complete the task. This resource list tells the reader what to gather before following the instructions. Digital information or any other relevant resources, including materials such as risk security policy and national bank guidelines, can be added in this section.

8. Write out the steps as simple task lists

Remember to make everything clear and easy to understand while writing. Writing your procedures out step by step can help you achieve this. Under the resources, you can begin writing the steps and instructions. You may collaborate with the professionals who complete the tasks to help you determine these steps and ensure accuracy and compliance with written policies and Federal Savings associations regulations.

9. Include supporting media

Visual elements like graphs, charts, and diagrams can help explain complicated information. What you see sticks more than what you hear, right? Consider adding visual elements to clarify complex information, such as credit risk, compliance programs, and regulation compliance risk.

10. Add relevant resources

To support the procedure, provide relevant resources, such as forms, templates, and reference materials. This will aid a comprehensive understanding of the procedures. Incorporating a work instruction template ensures that tasks are documented in a clear, step-by-step format, making it easier for employees to follow and apply the instructions effectively.

11. Avoid ambiguity in writing

Use straightforward language that is easy to understand. Avoid using technical jargon or complex terminology that may be unfamiliar to non-experts. Use specific language and avoid vague terms or phrases that may be open to interpretation. Define any technical terms or acronyms used in the procedure.

12. Include all health and safety information

Safety should be treated with all seriousness in your organization. Ensure all procedures include relevant health and safety information, such as emergency contact information, first aid instructions, and hazardous materials handling procedures.

13. Review the procedure for accuracy

After drafting your steps and instructions, consider reviewing and revising the writing. Make your writing as simple and actionable as possible. Use positive action words and short sentences to help you write clear instructions. Next, conduct a procedure test, which involves selecting an individual reading and completing the instructions to help you make adjustments.

14. Ask for feedback

After testing your procedure, you’ll also need feedback to make necessary adjustments. You can start by asking people who regularly complete the task for their advice. They may make suggestions or add instructional information. Next, you may ask a team member who doesn’t perform that task regularly for their advice to get a different view. They may ask questions or identify sections that could use more clarity.

11 Actionable Tips to Keep in Mind When Writing Bank Policies

You’re all set to begin writing your procedures, and with a little guidance, you’ll be well on your way to writing your institution’s policy. Here are the steps you’ll need.

1. Review the federal and state laws/regulations

Research the law. Your policies and procedures must adhere to relevant laws and regulations in the area. Research applicable rules during your planning process. Consider conferring with a legal professional to ensure complete legal compliance.

2. Review the gaps to address in the policy

Next, you’ll want to review and identify critical areas that must be addressed and improved in the policy. Some could be compliance with regulatory requirements, risk management, customer privacy and data security, employee responsibilities and training, and others. When you’re satisfied with your assessment, consult with legal, compliance, and industry experts to ensure all necessary areas are addressed.

3. Develop your document charter

How will your document be? Your document charter is just another word for your documented policies. Define the purpose and scope of the policy document, identify the target audience and stakeholders, determine the document’s structure and organization, set the tone and style of the document, define the key terms and definitions used in the document, and outline the responsible parties for maintaining and updating the document.

4. Seek the support of your bank’s executives

Groups are often more creative and productive than individuals who write policies and procedures independently. When developing your policies and procedures, try gathering a workgroup of individuals with insight into different aspects of your organization.

5. Make it readable

A bank policy should be written clearly and concisely, making it easy for employees to understand and follow. Use headings and subheadings to break up the content and make scanning easier. Use bullet points and numbered lists to list out procedures and requirements.

Keep your paragraphs short and focus on one idea or concept per paragraph. Use examples or scenarios to illustrate complex concepts or procedures. Visuals such as diagrams, flowcharts, or infographics can help explain complex processes or procedures.

6. Use clear and brief language

When writing a policy, use professional language that expresses precisely what you intend that item to accomplish. Try to maintain specificity whenever possible. Write policies that are meaningful and also relatively short. If you can explain a term using a few sentences, do so and avoid unnecessary fluff. This can help support greater clarity when communicating with members of your team.

7. Define key terms and concepts

You may try to sound as informal as possible when writing, but some technical words must be how they are. When you come upon such words, use definitions or explanations for them. Clearly define key terms and concepts used in the policy to avoid confusion and ensure consistency.

8. Write in simple, plain English

When drafting your policies, be careful not to eliminate those with little knowledge of the banking industry. Not every employee will understand the complex regulatory requirements of the industry. It is your job to ensure that each employee understands the document they’ll be reading. This will foster compliant behavior and keep the entire institution out of trouble.

9. Be accurate

When you write your policies, ensure that they are accurate and up to date and reflect the latest regulatory requirements and industry standards. In case of doubt, verify the accuracy of the information and data used in the policy.

10. Be specific

Provide specific examples and scenarios to illustrate the policy’s requirements and expectations. Use concrete language and avoid vague or general policy statements. Finally, specify the responsibilities and roles of different individuals and departments.

11. Add references

Relevant laws, regulations, and industry standards supporting the policy should be referenced. Primary sources, such as government websites or industry publications, should be cited or footnoted. While doing this, ensure you’re using reputable sources and that your information is current.

Develop Your Bank’s Policies and Procedures Using SweetProcess

Your institution’s policies and procedures are assets that function as compliance tools. When everything is put in writing, it helps provide clarity and consistency for employees at every level and protects them from violating federal and internal laws particular to your institution.

Remember, your policies and procedures are only as valuable as how much your employees use them.

SweetProcess takes care of that hassle and ensures everyone is on the same page. If they’re not, you’ll know immediately and do something about it. Given how easy and intuitive it is to create policies and procedures on it, it’s highly unlikely to happen. Either way, you’re in good hands. Sign up to begin your free trial. You don’t need a credit card!